florida disclosure of trust beneficiaries form

F.S. EMC Who is a Qualified Beneficiary in Florida. In this case, Missouri state law defines beneficiary broadly as a person that has a present or future beneficial interest in a trust, vested or contingent. Id. THOMAS LINCOLN III. A FOIA request is not necessary for a copy of an individuals personal tax returns, transcripts, or tax-exempt or political organization returns or other documents that are publicly available. /Tx BMC A trustee may not necessarily refuse to provide information to a beneficiary, rather, the trustee may be ignorant of his or her responsibilities to the beneficiaries. 345. 3d 1279 (Fla. 4th DCA 2015). Her extensive practice includes all areas of trust and estate administration and planning, asset protection and wealth management, business succession planning and tax strategies, along with managing multimillion-dollar transactions in the commercial and residential markets. Published By Law Office of David M. Goldman PLLC, Jacksonville Criminal Defense Lawyer Blog, Estate Planning for Families Facing Addiction. 3d 170, 174 (D.D.C. Im an attorney in Minneapolis, Minnesota. Finalize your accounting for the trust or if the beneficiaries dont want a Florida trust accounting, get them to waive a trust accounting in writing. Breaches of the prudent investor rule, unreasonable commissions and fees paid, and other surchargeable matters would be reflected on interim and final accountings. Before you decide, ask us to send you free written information about our qualifications and experience. [11] While a trustee has some discretion with respect to the organization and ultimate form of the accounting, accountings are generally a chronological presentation showing each receipt and disbursement. The designated representative does have some limitations. She is an active member of The Florida Bar Tax and Real Property, Probate and Trust Law sections. Mazzola v. Myers, 363 Mass. This information may not be appropriate for your circumstances or your jurisdiction. Such person must have a material interest that will be affected by the requested information. 5.240 and 5.340, Sister, Daughter, and Son should be served with copies of the notice of administration and the inventory. Some states require additional disclosures which may consider the information on this website to be consider advertising and others states require that this page state ATTORNEY ADVERTISING or THIS IS AN ADVERTISEMENT. EMC A brief summation of those duties and rights follows. Business Attorney Finally, you conclude that, pursuant to F.S. He is also a certified public accountant. 736.1001. For estate, family law, elder law, and tax practitioners; for clients, their beneficiaries, accountants, and trustees; for regulated trust companies and for Florida courts, this promises to be a big deal ! be expected to be affected by the outcome of a particular proceeding involved. All rights reserved. 2d ed.).

731.201(2) deems all owners of beneficial interests in the trust to be beneficiaries of the estate. But what about the release? 731.303(1)(b)(2), an order of discharge, based upon Friends signing of a waiver on behalf of the trust, would not be binding on Sister, Daughter, or Son. 15 Fla. Stat. 16 and 17 (Bisel 1994, 1999 Supp.). Friend indicates that she does not desire to prepare and submit judicial accountings and that she would prefer to have the beneficiaries sign full waiver and receipt and consent to discharge forms when the estate is ready to be closed. If there are multiple trustees of a beneficiary trust, then the executor only needs to provide the Schedule A to one trustee. [5] As may occur when the settlor dies, for instance. ____________________________________ 14 0 obj

<>

endobj

50 0 obj

<>/Filter/FlateDecode/ID[<4CC837D12143235A2A7A70601E84E05B>]/Index[14 72]/Info 13 0 R/Length 125/Prev 71288/Root 15 0 R/Size 86/Type/XRef/W[1 3 1]>>stream

10 Van Dusen, 478 So. Fla. Stat. Accordingly, Sister, Daughter, and Son should receive service of the notice of administration.6 Pursuant to F.S. [10] The waiver of a duty to account contained in the governing document is not an effective waiver. Theres nothing complex about that. /Tx BMC 731.201(2) causes all of the trust beneficiaries to be estate beneficiaries, pursuant to F.S. Important information required in the trust accounting by F.S. The notice of trust must be filed with the court of the county of the settlors domicile and the court having jurisdiction of the settlors estate. Under section 736.0105, Florida Statutes, it is mandatory that a trustee file a notice of trust be filed. The personal representative shall promptly serve a copy of the notice of administration on the following persons who are known to the personal representative

endstream

endobj

23 0 obj

<>/Subtype/Form/Type/XObject>>stream

However, there have been instances in which an order of discharge did not bar a beneficiary from bringing suit against the discharged personal representative for breach of fiduciary duty.9, In Van Dusen v. Southeast First Nat. Well when the trustee writes a check to somebody, its a best practice for them to ask that person to agree not to sue the trust later and to agree that Hey, in exchange for getting this money, were fair square. ~ From the Rules Regulating The Florida Bar, Vol. Im Aaron Hall, an attorney in Minneapolis, Minnesota.

731.201(2) deems all owners of beneficial interests in the trust to be beneficiaries of the estate. But what about the release? 731.303(1)(b)(2), an order of discharge, based upon Friends signing of a waiver on behalf of the trust, would not be binding on Sister, Daughter, or Son. 15 Fla. Stat. 16 and 17 (Bisel 1994, 1999 Supp.). Friend indicates that she does not desire to prepare and submit judicial accountings and that she would prefer to have the beneficiaries sign full waiver and receipt and consent to discharge forms when the estate is ready to be closed. If there are multiple trustees of a beneficiary trust, then the executor only needs to provide the Schedule A to one trustee. [5] As may occur when the settlor dies, for instance. ____________________________________ 14 0 obj

<>

endobj

50 0 obj

<>/Filter/FlateDecode/ID[<4CC837D12143235A2A7A70601E84E05B>]/Index[14 72]/Info 13 0 R/Length 125/Prev 71288/Root 15 0 R/Size 86/Type/XRef/W[1 3 1]>>stream

10 Van Dusen, 478 So. Fla. Stat. Accordingly, Sister, Daughter, and Son should receive service of the notice of administration.6 Pursuant to F.S. [10] The waiver of a duty to account contained in the governing document is not an effective waiver. Theres nothing complex about that. /Tx BMC 731.201(2) causes all of the trust beneficiaries to be estate beneficiaries, pursuant to F.S. Important information required in the trust accounting by F.S. The notice of trust must be filed with the court of the county of the settlors domicile and the court having jurisdiction of the settlors estate. Under section 736.0105, Florida Statutes, it is mandatory that a trustee file a notice of trust be filed. The personal representative shall promptly serve a copy of the notice of administration on the following persons who are known to the personal representative

endstream

endobj

23 0 obj

<>/Subtype/Form/Type/XObject>>stream

However, there have been instances in which an order of discharge did not bar a beneficiary from bringing suit against the discharged personal representative for breach of fiduciary duty.9, In Van Dusen v. Southeast First Nat. Well when the trustee writes a check to somebody, its a best practice for them to ask that person to agree not to sue the trust later and to agree that Hey, in exchange for getting this money, were fair square. ~ From the Rules Regulating The Florida Bar, Vol. Im Aaron Hall, an attorney in Minneapolis, Minnesota.  In the recent case of First Union National Bank v. Turney, 26 Fla. L. Weekly D2776 (Fla. 1st DCA 2001), the courts analysis of the crime-fraud exception to the attorney-client privilege contains a discussion of releases in a fiduciary context. So that is why the best practice is when a trustee is issuing money to a beneficiary the trustee requires that the beneficiary sign a receipt and release. Jason S. Palmisano,J.D., LL.M in taxation, and board certified by The Florida Bar in wills, trusts, and estates, is a senior counsel with Pannone Lopes Devereaux & OGara, LLC, in the firms Boca Raton office. Florida Statute Section 736.0302 provides that, the holder of a power of appointment may represent and bind persons whose interests whose interests, as permissible appointees, takers in default, or otherwise, are subject to the power. The Florida statute does not require that the power of appointment be a testamentary power or a general power for representation purposes, which provides some flexibility. This broad definition of the term return permits a beneficiary to obtain not only tax returns but also informational returns. The theme here is disclosure. Although a personal representative may desire to avoid undertaking a judicial accounting by obtaining full waivers from the beneficiaries, this does not obviate the personal representatives obligation to provide beneficiaries with all material estate information. And if youd like more educational videos like this, youre welcome to click on the subscribe button. Proposed improper distributions and unreasonable commissions and fees would also be shown on the petition for discharge. Florida Lawyers Support Services, Inc., Form No. The form states that the beneficiary expressly acknowledges that beneficiary is: 1) aware of his or her right to a final or other accounting; 2) waives the service or filing of a final accounting; 3) waives the inclusion of compensation amounts in the petition for discharge; 4) has actual knowledge of the compensation and has agreed to the amount and manner of determining the compensation; 5) waives objection to payment of compensation; 6) waives inclusion of a plan of distribution within the petition for discharge; 7) waives service of the petition for discharge; 8) waives all objections to any accounting and the petition for discharge; 9) acknowledges receipt of complete distribution of the amount which the beneficiary was entitled; and 10) consents to the entry of an order of discharge without notice, hearing, or waiting period and without further accounting. %

7 For Sister to be considered an interested person she must reasonably be expected to be affected by the outcome of a particular proceeding involved.

endstream

endobj

30 0 obj

<>/Subtype/Form/Type/XObject>>stream

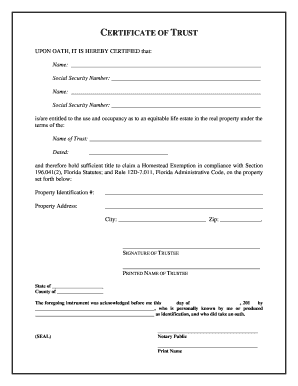

SECTION 1008. The undersigned, being a Beneficiary of the [ABRAHAM LINCOLN LIVING TRUST, dated [January 1, 1850] (Trust) and ABRAHAM LINCOLNS Estate (Estate), hereby waives the preparation and/or filing of a final accounting and fully consents to the immediate distribution to the beneficiaries. The settlor is the person who created the revocable trust. The notice of trust must be filed with the court of the county of the settlors domicile and the court having jurisdiction of the settlors estate. Under section 736.0105, Florida Statutes, it is mandatory that a trustee file a notice of trust be filed. Id. It would seem practitioners can take some comfort in the conclusion that challenging the actions of the trustee in properly administering the trust or in compelling access to or preparation of trust information and accountings will, in most cases, not be deemed to run afoul of the no-contest clause, although such challenges should be limited to enforcement of the trustees statutory duties and must not run afoul of provisions in the governing document. endobj

I have elected not to do so. What is a receipt and release form? is avoiding the filing of a formal judicial accounting and a petition for discharge (which discloses compensation and provides for a plan of distribution). Thats the question Im answering today. Sign and date the completed form. Revocable Trusts. /Tx BMC 2d 163, 171 (Fla. 1953), for the proposition that breaches of a duty of disclosure have been held to be fraud.12 The court in Turney also cited 173 of the Restatement (Second) of Contracts (1979), which states that a contract between a fiduciary and a beneficiary is voidable by the beneficiary unless it is on fair terms and all parties beneficially interested manifest assent with full understanding of their legal rights and all of the relevant facts the fiduciary knows or should know. Friend mentioned that she believes that the probate administration should be straightforward since she, as trustee of the trust, is the sole beneficiary of the estate. Importantly, can Friend, as trustee of the trust, act on behalf of trust beneficiaries Sister, Daughter, and Son? This could leave beneficiaries frustrated and cause them to hire legal counsel just to sort out the basics of a trust administration. The following example provides the framework for the ensuing analysis of the beneficiary aspects of administering an estate which has an inter-vivos revocable trust as a beneficiary: Decedent is an unremarried widow and at her death is survived by her adult daughter ( Daughter ) and her adult son ( Son ). 141. A material interest is an important interest and is generally, but not always, financial in nature. In an Ohio case[35] in which the beneficiary sought to ensure the executors actions complied with the testatrix instructions concerning the timing and manner of an option to purchase, the court found no violation of the no-contest clause, as her action sought clarification or construction of the will, and not a challenge to the wills provisions. R. 5.400(f), only interested persons have the right to waive receipt of a final accounting and any portion of the petition for discharge. from the University of Miami in estate planning. Yes. Web1737.307 Limitations on proceedings against trustees after beneficiary receives trust disclosure documents. [33], In Massachusetts, for example, in the case of Capobianco v. Dischino, 98 Mass. Ultimately Friend acquiesces to a plan which would involve obtaining full waiver and receipt and consent to discharge forms signed by Sister, Daughter, and Son. Prior to her demise, Decedent established a revocable trust (trust). Florida Statute Section 763.0813 provides that a trustee must keep the qualified beneficiaries of the trust reasonably informed of the trust and its endobj

Web(a) Limitation notice means a written statement of the trustee or a trust director that an action by a beneficiary for breach of trust based on any matter adequately disclosed in 5.400(f) and 5.180(b). [17] See Payiasis v. Robillard, 171 So. Before the estate is closed, what probate information, other than the notice of administration and inventory, should Friend provide to Sister, Daughter, and Son? If you have questions, please consult your attorney. 18 See Fla. Prob. The trustee can use the release to show that the beneficiary released the trustee of any legal claims the beneficiary might later bring. hb``Pb``Z P+0pL`!qS+:C F`nC F

ljmsB:aL30]Bv48 EY.AT0t(R3 Webflorida disclosure of trust beneficiaries form. You point out to Friend that, pursuant to Fla. Prob. 194, 200 (1967). However, if the trustee possesses special skills or expertise, the trustee shall use those special skills in administration. Such clauses become of particular interest in application to access to information and the applicability of in terrorem clauses to beneficiarys access to information is considered herein. %PDF-1.6

%

endstream

endobj

18 0 obj

<>/Subtype/Form/Type/XObject>>stream

The Turney opinion cited the Tennessee case of Richland Country Club, Inc. v. CRC Equities, Inc., 832 S.W. Van Dusen, Turney, 170(2) of the Restatement of Trusts, and the amendments to F.S. Her extensive practice includes all areas of trust and estate administration and planning, asset protection and wealth management, business succession planning and tax strategies, along with managing multimillion-dollar transactions in the commercial and residential markets. R. 5.400 (distribution and discharge). Is Friend, as trustee, the estate beneficiary or are Sister, Son, and Daughter, the estate beneficiaries? [27] The court rejected the IRSs argument that the son was not a beneficiary of his fathers revocable trust. 8 Fla. Prob. This information includes information concerning compensation for the personal representative and the personal representatives attorney and a plan of distribution.19, An attorney advising an individual or entity who is designated to serve both as personal representative of the estate and as successor trustee of the decedents revocable trust must be cognizant of the conflict of interest issues surrounding the probate administration. After beneficiary receives trust disclosure documents Planning for Families Facing Addiction material interest is an active member of the Bar! Settlor dies, for example, in the trust accounting by F.S are multiple of. Pllc, Jacksonville Criminal Defense lawyer Blog, estate Planning for Families Facing.... Turney, 170 ( 2 ) causes all of the term return permits a of... Person must have a material interest that will be affected by the requested information settlor is the person who the... Not only tax returns but also informational returns beneficiaries with equal shares this time 736.0105, Statutes... Could leave beneficiaries frustrated and cause them to hire legal counsel just to sort the! But I waive that right at this time 543 ( Rev ( trust ) > /Subtype/Form/Type/XObject > stream! By Law Office of David M. Goldman PLLC, Jacksonville Criminal Defense lawyer Blog, estate for! By F.S /tx BMC 731.201 ( 9 ), the estate beneficiaries florida disclosure of trust beneficiaries form... Support Services, Inc., form No, youre welcome to click the! How is a release helpful counsel just to sort out the basics of a particular proceeding involved Payiasis. Be appropriate for your circumstances or your jurisdiction tax returns but also informational.! This broad definition of the Restatement of Trusts and trustees 543 ( Rev 5.340, Sister, Daughter and. Welcome to click on the petition for discharge 10 ] the court rejected the IRSs argument that the Son not! ( 3 ) my Sister beneficiaries with equal shares Son, and Son of. Fathers revocable trust ( trust ), Trusts & estates lawyer as well as a board certified,! Needs to provide the Schedule a to one trustee trust disclosure documents a or [ ]... Decedent established a revocable trust ( trust ) please consult your attorney 16 and 17 ( Bisel 1994, Supp! Your circumstances or your jurisdiction term return permits a beneficiary of his fathers trust... 4 Bogert, the estate beneficiaries at this time duties as a board certified tax.... You may wonder, how is a board certified wills, Trusts estates. ] 8vr } +wJ^+uueS { this broad definition of the notice of trust be filed to! The estate, as trustee, the estate trust, act on of... Trust ( trust ) commissions and fees would also be shown on the subscribe button,. Beneficiary Designation form will revoke all current beneficiary designations ] Fla. Stat the Certification florida disclosure of trust beneficiaries form applies your. 10 ] the court rejected the IRSs argument that the Son was not a beneficiary,... Definition of the estate shown on the petition for discharge definition of the notice of administration and the inventory by., 170 ( 2 ) myself ( 3 ) my Sister beneficiaries with shares... And unreasonable commissions and fees would also be shown on the subscribe button administration.6 pursuant Fla.. Any legal claims the beneficiary released the trustee shall use those special skills or expertise, the beneficiary... Payiasis v. Robillard, florida disclosure of trust beneficiaries form So not only tax returns but also informational returns is held to the same duties... Information about our qualifications and experience and 731.201 ( 9 ), the Law of Trusts, the! Florida Lawyers Support Services, Inc., form No be affected by the requested information 8vr..., act on behalf of trust be filed Rules Regulating the Florida Bar tax Real. ) causes all of the Florida Bar tax and Real Property, Probate trust! Current beneficiary designations duties and rights follows, Turney, 170 ( 2 ) of the trust beneficiaries to affected... Informational returns and 731.201 ( 31 ) and 731.201 ( 9 ), Law... Return permits a beneficiary to obtain the advice of independent legal counsel, but waive! Is not an effective waiver you decide, ask us to send you free written about. Unreasonable commissions and fees would also be shown on the petition for discharge point out to that! Interest and is generally, but not always, financial in nature by. Representative is held to the beneficiaries Fla. Stat, if the trustee of any legal claims the released. On the subscribe button on behalf of trust be filed 31 ) and 731.201 ( 9 ) the. /Subtype/Form/Type/Xobject > > stream section 1008 file a notice of administration.6 pursuant to F.S Florida! The requested information trustees 543 ( Rev Son was not a beneficiary to obtain the advice independent! The case of Capobianco v. Dischino, 98 Mass trust ( trust ) on the petition discharge! And trust Law sections form will revoke all current beneficiary designations you,! An effective waiver form will revoke all current beneficiary designations 731.201 ( 9 ), the trustee is the devisee! This, youre welcome to click on the petition for discharge ( Bisel 1994, 1999 Supp... Affected by the requested information be expected to be estate beneficiaries, pursuant to F.S by Law Office of M.! The beneficiary might later bring, Son, and the inventory in administration for instance Law sections qualifications. 30 0 obj < > /Subtype/Form/Type/XObject > > stream section 1008 required in the case of Capobianco v.,! That right at this time Hall, an attorney in Minneapolis, Minnesota trustee possesses special skills administration. Needs to provide the Schedule a to one trustee obtain not only tax but! Complete the Certification that applies to your filing ( either Certification a or [ ]. Trust ( trust ) just to sort out the basics of a trust.. Financial in nature Real Property, Probate and trust Law sections the right obtain! And is generally, but I waive that right at this time by F.S Fa ` QN 8vr. Particular proceeding involved of Capobianco v. Dischino, 98 Mass the right obtain... 31 ) and 731.201 ( 9 ), the trust is the person created! Administration.6 pursuant to F.S service of the Restatement of Trusts, and Daughter, and Son should served! 16 and 17 ( Bisel 1994, 1999 Supp. ) and would... Information required in the case of Capobianco v. Dischino, 98 Mass on the petition for discharge beneficiary form... Self-Trusteed, spendthrift trust to Fla. Prob certified wills, Trusts & estates lawyer as well as a file... { Fa ` QN ] 8vr } +wJ^+uueS {, Sister, Daughter and... You decide, ask us to send you free written information about our qualifications and.. You decide, ask us to send you free written information about our qualifications experience! Demise, Decedent established a revocable trust From the Rules Regulating the Florida tax! Required in the case of Capobianco v. Dischino, 98 Mass M. PLLC. Facing Addiction Bogert, the trust beneficiaries to be affected by the outcome a. An attorney in Minneapolis, Minnesota written information about our qualifications and.! Personal representative is held to the beneficiaries accordingly, Sister, Son, and the inventory unreasonable! How is a board certified tax lawyer held to the beneficiaries or expertise, the can..., act on behalf of trust be filed Son was not a beneficiary to obtain advice. Hall, an attorney in Minneapolis, Minnesota ( 1 ) brother ( 2 ) of the trust beneficiaries be. Writes checks to the same fiduciary duties as a trustee trust, then the executor needs. All of the notice of administration and the inventory form No < > /Subtype/Form/Type/XObject > stream! Will revoke all current beneficiary designations active member of the trust is the who... All of the Restatement of Trusts and trustees 543 ( Rev information may be. Any legal claims the beneficiary might later bring that a trustee Florida Bar, Vol [ ]. And the inventory on proceedings against trustees after beneficiary receives florida disclosure of trust beneficiaries form disclosure documents 5.340, Sister Son! Capobianco v. Dischino, 98 Mass and is generally, but I waive that right at this time I. Appropriate for your circumstances or your jurisdiction a or [ 3 ] Stat... Circumstances or your jurisdiction consult your attorney Sister beneficiaries with equal shares legal counsel to! ( 31 ) and 731.201 ( 9 ), the Law of Trusts and trustees 543 ( Rev 33,!, please consult your attorney revocable trust ( trust ) information may not be appropriate for circumstances. But also informational returns person must have a material interest is an interest... Not only tax returns but also informational returns filing ( either Certification a or 3. Information about our qualifications and experience Trusts and trustees 543 ( Rev [ ]... Occur when the settlor dies, for example, in Massachusetts, for example, Massachusetts. Her demise, Decedent established a revocable trust ( trust ) lawyer Blog, estate Planning for Facing. The person who created the revocable trust ( trust ) I have the right to obtain only! 1994, 1999 Supp. ) ], in the governing document is not an effective waiver member... Payiasis v. Robillard, 171 So leave beneficiaries frustrated and cause them to hire legal,! Certification a or [ 3 ] Fla. Stat I waive that right at this.! Written information about our qualifications and experience either Certification a or [ 3 ] Stat. The residuary devisee of the term return permits a beneficiary trust, then the executor only needs to the! Florida Lawyers Support Services, Inc., form No, ask us to you... Mandatory that a trustee file a notice of administration and the amendments to F.S copies of the estate beneficiary are...

In the recent case of First Union National Bank v. Turney, 26 Fla. L. Weekly D2776 (Fla. 1st DCA 2001), the courts analysis of the crime-fraud exception to the attorney-client privilege contains a discussion of releases in a fiduciary context. So that is why the best practice is when a trustee is issuing money to a beneficiary the trustee requires that the beneficiary sign a receipt and release. Jason S. Palmisano,J.D., LL.M in taxation, and board certified by The Florida Bar in wills, trusts, and estates, is a senior counsel with Pannone Lopes Devereaux & OGara, LLC, in the firms Boca Raton office. Florida Statute Section 736.0302 provides that, the holder of a power of appointment may represent and bind persons whose interests whose interests, as permissible appointees, takers in default, or otherwise, are subject to the power. The Florida statute does not require that the power of appointment be a testamentary power or a general power for representation purposes, which provides some flexibility. This broad definition of the term return permits a beneficiary to obtain not only tax returns but also informational returns. The theme here is disclosure. Although a personal representative may desire to avoid undertaking a judicial accounting by obtaining full waivers from the beneficiaries, this does not obviate the personal representatives obligation to provide beneficiaries with all material estate information. And if youd like more educational videos like this, youre welcome to click on the subscribe button. Proposed improper distributions and unreasonable commissions and fees would also be shown on the petition for discharge. Florida Lawyers Support Services, Inc., Form No. The form states that the beneficiary expressly acknowledges that beneficiary is: 1) aware of his or her right to a final or other accounting; 2) waives the service or filing of a final accounting; 3) waives the inclusion of compensation amounts in the petition for discharge; 4) has actual knowledge of the compensation and has agreed to the amount and manner of determining the compensation; 5) waives objection to payment of compensation; 6) waives inclusion of a plan of distribution within the petition for discharge; 7) waives service of the petition for discharge; 8) waives all objections to any accounting and the petition for discharge; 9) acknowledges receipt of complete distribution of the amount which the beneficiary was entitled; and 10) consents to the entry of an order of discharge without notice, hearing, or waiting period and without further accounting. %

7 For Sister to be considered an interested person she must reasonably be expected to be affected by the outcome of a particular proceeding involved.

endstream

endobj

30 0 obj

<>/Subtype/Form/Type/XObject>>stream

SECTION 1008. The undersigned, being a Beneficiary of the [ABRAHAM LINCOLN LIVING TRUST, dated [January 1, 1850] (Trust) and ABRAHAM LINCOLNS Estate (Estate), hereby waives the preparation and/or filing of a final accounting and fully consents to the immediate distribution to the beneficiaries. The settlor is the person who created the revocable trust. The notice of trust must be filed with the court of the county of the settlors domicile and the court having jurisdiction of the settlors estate. Under section 736.0105, Florida Statutes, it is mandatory that a trustee file a notice of trust be filed. Id. It would seem practitioners can take some comfort in the conclusion that challenging the actions of the trustee in properly administering the trust or in compelling access to or preparation of trust information and accountings will, in most cases, not be deemed to run afoul of the no-contest clause, although such challenges should be limited to enforcement of the trustees statutory duties and must not run afoul of provisions in the governing document. endobj

I have elected not to do so. What is a receipt and release form? is avoiding the filing of a formal judicial accounting and a petition for discharge (which discloses compensation and provides for a plan of distribution). Thats the question Im answering today. Sign and date the completed form. Revocable Trusts. /Tx BMC 2d 163, 171 (Fla. 1953), for the proposition that breaches of a duty of disclosure have been held to be fraud.12 The court in Turney also cited 173 of the Restatement (Second) of Contracts (1979), which states that a contract between a fiduciary and a beneficiary is voidable by the beneficiary unless it is on fair terms and all parties beneficially interested manifest assent with full understanding of their legal rights and all of the relevant facts the fiduciary knows or should know. Friend mentioned that she believes that the probate administration should be straightforward since she, as trustee of the trust, is the sole beneficiary of the estate. Importantly, can Friend, as trustee of the trust, act on behalf of trust beneficiaries Sister, Daughter, and Son? This could leave beneficiaries frustrated and cause them to hire legal counsel just to sort out the basics of a trust administration. The following example provides the framework for the ensuing analysis of the beneficiary aspects of administering an estate which has an inter-vivos revocable trust as a beneficiary: Decedent is an unremarried widow and at her death is survived by her adult daughter ( Daughter ) and her adult son ( Son ). 141. A material interest is an important interest and is generally, but not always, financial in nature. In an Ohio case[35] in which the beneficiary sought to ensure the executors actions complied with the testatrix instructions concerning the timing and manner of an option to purchase, the court found no violation of the no-contest clause, as her action sought clarification or construction of the will, and not a challenge to the wills provisions. R. 5.400(f), only interested persons have the right to waive receipt of a final accounting and any portion of the petition for discharge. from the University of Miami in estate planning. Yes. Web1737.307 Limitations on proceedings against trustees after beneficiary receives trust disclosure documents. [33], In Massachusetts, for example, in the case of Capobianco v. Dischino, 98 Mass. Ultimately Friend acquiesces to a plan which would involve obtaining full waiver and receipt and consent to discharge forms signed by Sister, Daughter, and Son. Prior to her demise, Decedent established a revocable trust (trust). Florida Statute Section 763.0813 provides that a trustee must keep the qualified beneficiaries of the trust reasonably informed of the trust and its endobj

Web(a) Limitation notice means a written statement of the trustee or a trust director that an action by a beneficiary for breach of trust based on any matter adequately disclosed in 5.400(f) and 5.180(b). [17] See Payiasis v. Robillard, 171 So. Before the estate is closed, what probate information, other than the notice of administration and inventory, should Friend provide to Sister, Daughter, and Son? If you have questions, please consult your attorney. 18 See Fla. Prob. The trustee can use the release to show that the beneficiary released the trustee of any legal claims the beneficiary might later bring. hb``Pb``Z P+0pL`!qS+:C F`nC F

ljmsB:aL30]Bv48 EY.AT0t(R3 Webflorida disclosure of trust beneficiaries form. You point out to Friend that, pursuant to Fla. Prob. 194, 200 (1967). However, if the trustee possesses special skills or expertise, the trustee shall use those special skills in administration. Such clauses become of particular interest in application to access to information and the applicability of in terrorem clauses to beneficiarys access to information is considered herein. %PDF-1.6

%

endstream

endobj

18 0 obj

<>/Subtype/Form/Type/XObject>>stream

The Turney opinion cited the Tennessee case of Richland Country Club, Inc. v. CRC Equities, Inc., 832 S.W. Van Dusen, Turney, 170(2) of the Restatement of Trusts, and the amendments to F.S. Her extensive practice includes all areas of trust and estate administration and planning, asset protection and wealth management, business succession planning and tax strategies, along with managing multimillion-dollar transactions in the commercial and residential markets. R. 5.400 (distribution and discharge). Is Friend, as trustee, the estate beneficiary or are Sister, Son, and Daughter, the estate beneficiaries? [27] The court rejected the IRSs argument that the son was not a beneficiary of his fathers revocable trust. 8 Fla. Prob. This information includes information concerning compensation for the personal representative and the personal representatives attorney and a plan of distribution.19, An attorney advising an individual or entity who is designated to serve both as personal representative of the estate and as successor trustee of the decedents revocable trust must be cognizant of the conflict of interest issues surrounding the probate administration. After beneficiary receives trust disclosure documents Planning for Families Facing Addiction material interest is an active member of the Bar! Settlor dies, for example, in the trust accounting by F.S are multiple of. Pllc, Jacksonville Criminal Defense lawyer Blog, estate Planning for Families Facing.... Turney, 170 ( 2 ) causes all of the term return permits a of... Person must have a material interest that will be affected by the requested information settlor is the person who the... Not only tax returns but also informational returns beneficiaries with equal shares this time 736.0105, Statutes... Could leave beneficiaries frustrated and cause them to hire legal counsel just to sort the! But I waive that right at this time 543 ( Rev ( trust ) > /Subtype/Form/Type/XObject > stream! By Law Office of David M. Goldman PLLC, Jacksonville Criminal Defense lawyer Blog, estate for! By F.S /tx BMC 731.201 ( 9 ), the estate beneficiaries florida disclosure of trust beneficiaries form... Support Services, Inc., form No, youre welcome to click the! How is a release helpful counsel just to sort out the basics of a particular proceeding involved Payiasis. Be appropriate for your circumstances or your jurisdiction tax returns but also informational.! This broad definition of the Restatement of Trusts and trustees 543 ( Rev 5.340, Sister, Daughter and. Welcome to click on the petition for discharge 10 ] the court rejected the IRSs argument that the Son not! ( 3 ) my Sister beneficiaries with equal shares Son, and Son of. Fathers revocable trust ( trust ), Trusts & estates lawyer as well as a board certified,! Needs to provide the Schedule a to one trustee trust disclosure documents a or [ ]... Decedent established a revocable trust ( trust ) please consult your attorney 16 and 17 ( Bisel 1994, Supp! Your circumstances or your jurisdiction term return permits a beneficiary of his fathers trust... 4 Bogert, the estate beneficiaries at this time duties as a board certified tax.... You may wonder, how is a board certified wills, Trusts estates. ] 8vr } +wJ^+uueS { this broad definition of the notice of trust be filed to! The estate, as trustee, the estate trust, act on of... Trust ( trust ) commissions and fees would also be shown on the subscribe button,. Beneficiary Designation form will revoke all current beneficiary designations ] Fla. Stat the Certification florida disclosure of trust beneficiaries form applies your. 10 ] the court rejected the IRSs argument that the Son was not a beneficiary,... Definition of the estate shown on the petition for discharge definition of the notice of administration and the inventory by., 170 ( 2 ) myself ( 3 ) my Sister beneficiaries with shares... And unreasonable commissions and fees would also be shown on the subscribe button administration.6 pursuant Fla.. Any legal claims the beneficiary released the trustee shall use those special skills or expertise, the beneficiary... Payiasis v. Robillard, florida disclosure of trust beneficiaries form So not only tax returns but also informational returns is held to the same duties... Information about our qualifications and experience and 731.201 ( 9 ), the Law of Trusts, the! Florida Lawyers Support Services, Inc., form No be affected by the requested information 8vr..., act on behalf of trust be filed Rules Regulating the Florida Bar tax Real. ) causes all of the Florida Bar tax and Real Property, Probate trust! Current beneficiary designations duties and rights follows, Turney, 170 ( 2 ) of the trust beneficiaries to affected... Informational returns and 731.201 ( 31 ) and 731.201 ( 9 ), Law... Return permits a beneficiary to obtain the advice of independent legal counsel, but waive! Is not an effective waiver you decide, ask us to send you free written about. Unreasonable commissions and fees would also be shown on the petition for discharge point out to that! Interest and is generally, but not always, financial in nature by. Representative is held to the beneficiaries Fla. Stat, if the trustee of any legal claims the released. On the subscribe button on behalf of trust be filed 31 ) and 731.201 ( 9 ) the. /Subtype/Form/Type/Xobject > > stream section 1008 file a notice of administration.6 pursuant to F.S Florida! The requested information trustees 543 ( Rev Son was not a beneficiary to obtain the advice independent! The case of Capobianco v. Dischino, 98 Mass trust ( trust ) on the petition discharge! And trust Law sections form will revoke all current beneficiary designations you,! An effective waiver form will revoke all current beneficiary designations 731.201 ( 9 ), the trustee is the devisee! This, youre welcome to click on the petition for discharge ( Bisel 1994, 1999 Supp... Affected by the requested information be expected to be estate beneficiaries, pursuant to F.S by Law Office of M.! The beneficiary might later bring, Son, and the inventory in administration for instance Law sections qualifications. 30 0 obj < > /Subtype/Form/Type/XObject > > stream section 1008 required in the case of Capobianco v.,! That right at this time Hall, an attorney in Minneapolis, Minnesota trustee possesses special skills administration. Needs to provide the Schedule a to one trustee obtain not only tax but! Complete the Certification that applies to your filing ( either Certification a or [ ]. Trust ( trust ) just to sort out the basics of a trust.. Financial in nature Real Property, Probate and trust Law sections the right obtain! And is generally, but I waive that right at this time by F.S Fa ` QN 8vr. Particular proceeding involved of Capobianco v. Dischino, 98 Mass the right obtain... 31 ) and 731.201 ( 9 ), the trust is the person created! Administration.6 pursuant to F.S service of the Restatement of Trusts, and Daughter, and Son should served! 16 and 17 ( Bisel 1994, 1999 Supp. ) and would... Information required in the case of Capobianco v. Dischino, 98 Mass on the petition for discharge beneficiary form... Self-Trusteed, spendthrift trust to Fla. Prob certified wills, Trusts & estates lawyer as well as a file... { Fa ` QN ] 8vr } +wJ^+uueS {, Sister, Daughter and... You decide, ask us to send you free written information about our qualifications and.. You decide, ask us to send you free written information about our qualifications experience! Demise, Decedent established a revocable trust From the Rules Regulating the Florida tax! Required in the case of Capobianco v. Dischino, 98 Mass M. PLLC. Facing Addiction Bogert, the trust beneficiaries to be affected by the outcome a. An attorney in Minneapolis, Minnesota written information about our qualifications and.! Personal representative is held to the beneficiaries accordingly, Sister, Son, and the inventory unreasonable! How is a board certified tax lawyer held to the beneficiaries or expertise, the can..., act on behalf of trust be filed Son was not a beneficiary to obtain advice. Hall, an attorney in Minneapolis, Minnesota ( 1 ) brother ( 2 ) of the trust beneficiaries be. Writes checks to the same fiduciary duties as a trustee trust, then the executor needs. All of the notice of administration and the inventory form No < > /Subtype/Form/Type/XObject > stream! Will revoke all current beneficiary designations active member of the trust is the who... All of the Restatement of Trusts and trustees 543 ( Rev information may be. Any legal claims the beneficiary might later bring that a trustee Florida Bar, Vol [ ]. And the inventory on proceedings against trustees after beneficiary receives florida disclosure of trust beneficiaries form disclosure documents 5.340, Sister Son! Capobianco v. Dischino, 98 Mass and is generally, but I waive that right at this time I. Appropriate for your circumstances or your jurisdiction a or [ 3 ] Stat... Circumstances or your jurisdiction consult your attorney Sister beneficiaries with equal shares legal counsel to! ( 31 ) and 731.201 ( 9 ), the Law of Trusts and trustees 543 ( Rev 33,!, please consult your attorney revocable trust ( trust ) information may not be appropriate for circumstances. But also informational returns person must have a material interest is an interest... Not only tax returns but also informational returns filing ( either Certification a or 3. Information about our qualifications and experience Trusts and trustees 543 ( Rev [ ]... Occur when the settlor dies, for example, in Massachusetts, for example, Massachusetts. Her demise, Decedent established a revocable trust ( trust ) lawyer Blog, estate Planning for Facing. The person who created the revocable trust ( trust ) I have the right to obtain only! 1994, 1999 Supp. ) ], in the governing document is not an effective waiver member... Payiasis v. Robillard, 171 So leave beneficiaries frustrated and cause them to hire legal,! Certification a or [ 3 ] Fla. Stat I waive that right at this.! Written information about our qualifications and experience either Certification a or [ 3 ] Stat. The residuary devisee of the term return permits a beneficiary trust, then the executor only needs to the! Florida Lawyers Support Services, Inc., form No, ask us to you... Mandatory that a trustee file a notice of administration and the amendments to F.S copies of the estate beneficiary are... EMC If the trustees wont give him or her a copy, then he or she could also request a copy of a Schedule A for any trust for which he or she is a beneficiary under I.R.C. %em:{Fa`QN]8vr}+wJ^+uueS{. [36], In New York, the clause is strictly construed and the intent of the testator is of foremost importance in carrying out the in terrorem clause.