pennsylvania capital gains tax on home sale

86RMxk BT W fV(,oQCyPw\ZN jiIPqwr^LaU:\O]

EJNM'cKrFua If the property was acquired prior to June 1, 1971, the taxpayer must also obtain However, if any portion of the gain is taxable due to nonresidential (business/rental) use of the property, the worksheet included with

86RMxk BT W fV(,oQCyPw\ZN jiIPqwr^LaU:\O]

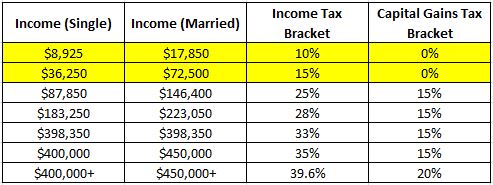

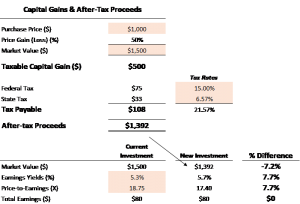

EJNM'cKrFua If the property was acquired prior to June 1, 1971, the taxpayer must also obtain However, if any portion of the gain is taxable due to nonresidential (business/rental) use of the property, the worksheet included with  The amount deducted on the return and not disallowed, but only to the extent the deduction results in a reduction of income; and. 1 1 28.4634 17.867 re Personal Income Tax Bulletin 2005-02, Gain or Loss Derived from the Disposition of a Going Concern. WebSo if your net proceeds are $270,000 and your cost basis is $250,000, youll be responsible for capital gains taxes on $20,000 of profit. The higher the basis, the lower your potentially taxable profit. Such a method may only be used if the property, when placed in service, has the same adjusted basis for Federal income tax purposes and the method or convention is allowable for Federal income tax purposes at the time the property is placed in service or under the Internal Revenue Code of 1986, whichever is earlier. 0.929993 0.089996 0.119995 rg For taxable years beginning after Dec. 31, 2004, Act 40 of July 7, 2005 provides that exchanges of insurance contracts under IRC Section 1035 that are tax exempt for federal income tax purposes are also tax exempt for Pennsylvania personal income tax purposes. If the proceeds are invested in real property located outside of Pennsylvania, the associated gain is generally PA-40 Schedule D gain. If your income falls in the $44,626$492,300 range, for 2023, your tax rate is Proudly founded in 1681 as a place of tolerance and freedom. This can be given to you if you have a good reason for selling the Pennsylvania home, you aren't subject to expatriate tax, and you haven't filed for exclusion in the past 2 years. PA Personal Income Tax Guide -Dividends, for additional information. Identifying the transaction on PA-40 Schedule D as an installment sale. Sale of stocks and bonds other than federal obligations or Pennsylvania obligations Refer to Any gain from the sale of the home, minus depreciation, is taxable since the residence is currently being used for rental purposes. If only part of the payment obligation under the contract is discharged by the repossession, figure the basis using only that amount instead of the full face value of the contract.). Short-term capital gains result from selling a Pennsylvania property that you owned for less than a year. You would need to report the home sale and potentially pay a capital gains tax on the $75,000 profit. Updated 11/14/2022 05:01 AM. :>Qe+*)ZsTG.Y:(*ZQi=

-o`I ;6c

`*#?`fc&c#xX%&V$!so8qw8~;2.q0A0=Xg(*L`41E2Mq

8Ca31O ~*Y$GW_ d6dM#[hG?:cq6F+%x,sXcg5pvBsqh*Z}[\au=r93 yb(-Z"][O/Pf@bX:F5rHl(lba1 For married filers, at least one spouse should have owned the property for at least 2 years within the five years preceding the home sale. Any distribution greater than basis is reported as a PA Schedule D Gain. Pennsylvania will follow the federal dealer classification rules in administrating these rules. Even though the majority of Pennsylvania homeowners are eligible for a capital gains tax break under the tax code, there are still instances when a house is fully taxable.

The amount deducted on the return and not disallowed, but only to the extent the deduction results in a reduction of income; and. 1 1 28.4634 17.867 re Personal Income Tax Bulletin 2005-02, Gain or Loss Derived from the Disposition of a Going Concern. WebSo if your net proceeds are $270,000 and your cost basis is $250,000, youll be responsible for capital gains taxes on $20,000 of profit. The higher the basis, the lower your potentially taxable profit. Such a method may only be used if the property, when placed in service, has the same adjusted basis for Federal income tax purposes and the method or convention is allowable for Federal income tax purposes at the time the property is placed in service or under the Internal Revenue Code of 1986, whichever is earlier. 0.929993 0.089996 0.119995 rg For taxable years beginning after Dec. 31, 2004, Act 40 of July 7, 2005 provides that exchanges of insurance contracts under IRC Section 1035 that are tax exempt for federal income tax purposes are also tax exempt for Pennsylvania personal income tax purposes. If the proceeds are invested in real property located outside of Pennsylvania, the associated gain is generally PA-40 Schedule D gain. If your income falls in the $44,626$492,300 range, for 2023, your tax rate is Proudly founded in 1681 as a place of tolerance and freedom. This can be given to you if you have a good reason for selling the Pennsylvania home, you aren't subject to expatriate tax, and you haven't filed for exclusion in the past 2 years. PA Personal Income Tax Guide -Dividends, for additional information. Identifying the transaction on PA-40 Schedule D as an installment sale. Sale of stocks and bonds other than federal obligations or Pennsylvania obligations Refer to Any gain from the sale of the home, minus depreciation, is taxable since the residence is currently being used for rental purposes. If only part of the payment obligation under the contract is discharged by the repossession, figure the basis using only that amount instead of the full face value of the contract.). Short-term capital gains result from selling a Pennsylvania property that you owned for less than a year. You would need to report the home sale and potentially pay a capital gains tax on the $75,000 profit. Updated 11/14/2022 05:01 AM. :>Qe+*)ZsTG.Y:(*ZQi=

-o`I ;6c

`*#?`fc&c#xX%&V$!so8qw8~;2.q0A0=Xg(*L`41E2Mq

8Ca31O ~*Y$GW_ d6dM#[hG?:cq6F+%x,sXcg5pvBsqh*Z}[\au=r93 yb(-Z"][O/Pf@bX:F5rHl(lba1 For married filers, at least one spouse should have owned the property for at least 2 years within the five years preceding the home sale. Any distribution greater than basis is reported as a PA Schedule D Gain. Pennsylvania will follow the federal dealer classification rules in administrating these rules. Even though the majority of Pennsylvania homeowners are eligible for a capital gains tax break under the tax code, there are still instances when a house is fully taxable.  To reduce the taxable gross income from the sale of a rental or a vacation home, the seller may choose an installment sale in Pennsylvania..

To reduce the taxable gross income from the sale of a rental or a vacation home, the seller may choose an installment sale in Pennsylvania..  If you own a rental, a better option would be to offset capital gains with capital losses. If the sale of their home was required by unforeseen circumstances (change of employment status or health)the gaincould be excluded. This rule only applies to dealers in real property.

If you own a rental, a better option would be to offset capital gains with capital losses. If the sale of their home was required by unforeseen circumstances (change of employment status or health)the gaincould be excluded. This rule only applies to dealers in real property.  Capital gains tax is the tax you owe on your capital gains (profit) from the sale of a capital asset or investment just as a home. The cost basis in the property received is the fair market value. This way, you can take advantage of Section 121 or primary residence exclusion. A residence is a house, lodging, or other place of habitation, including a trailer or condominium that has independent or self-contained cooking, sleeping, and sanitation facilities. Special tax provisions, however, apply with respect to the calculation of gain on property acquired before June 1, 1971. Sale of ownership interest in partnerships and business enterprises. Pennsylvania also has no provisions for the carryover of losses from one tax year to another year. Personal Income Tax Bulletin 2005-02, Gain or Loss Derived from the Disposition of a Going Concern, for additional information regarding the taxability of goodwill for nonresidents. That $100,000 would be subtracted from the sales price of your home this year. Beginning in tax year 2020, PA follows the rules under IRC Section 1400Z-2(c) of the Internal Revenue Code of 1986, as amended. 7303(a.2) states that the basis in property shall be reduced, but not below zero, for depreciation by the greater of: A resident shareholder or partner must report as taxable gain for the tax year in which it was received or credited, the excess of the fair market value of any return-of-capital distribution over the adjusted basis of the stock or partnership interest on the PA-40 Schedule D. A return-of-capital distribution is any distribution that is not made or credited by a business corporation or association out of its earnings and profits. Some of the differences include, but are not limited to: sales of business assets; IRC Section 338(h)(10) transactions; like-kind exchanges; wash sales; capital gains distributions; bona fide sales to related parties; and transactions related to fraudulent investment schemes. Refer to Personal Income Tax Bulletin 2009-01, Treatment of Demutualization for Pennsylvania Personal Income Tax (PA PIT) Purposes for additional information regarding the reporting of the transaction and basis determination at time of receipt of the stock. The capital gains tax rate is also at a 37% ceiling. Lets say you have a $250,000 tax basis in a home youve owned for 5 years that sells for $350,000. In most cases, it is harder to get capital gains tax relief from a rental sale in Pennsylvania. Pennsylvania will deem the election to have been made in the following instances: If a taxpayer reports an isolated transaction as an installment sale at the time of filing the PA-40 Individual Income Tax Return by: Once the election is made, the taxpayer will not be allowed to change the method of reporting in subsequent years. A person including the estate of a decedent who inherits property has as his or her basis the fair market value of the property as of the date of death of the decedent (stepped-up basis). Should two states get to tax a capital gain if I was a year round resident in one 0 3 10,621 Reply 1 Best answer TerryA Level 7 June 3, 2019 4:22 PM If the property was in another state, such as real estate, then that state gets to tax the gain as well as does your resident state. Proceeds from the sale of land and/or building used to generate rental income. PA Schedule C. Taxpayers must make an election if they wish to use the installment method. En*)r1GHtyr*kg Refer to PA Personal Income Tax Guide - Interest, for additional information. Certain selling costs such as title insurance, settlement fees, etc. Therefore, only transactions displaying net gains and losses on tangible property located within Pennsylvania are required to be reported on PA Schedule D. Any gain reported on a PA-20S/PA-65 Schedule NRK-1 should be and is presumed to be Pennsylvania-source income.

Capital gains tax is the tax you owe on your capital gains (profit) from the sale of a capital asset or investment just as a home. The cost basis in the property received is the fair market value. This way, you can take advantage of Section 121 or primary residence exclusion. A residence is a house, lodging, or other place of habitation, including a trailer or condominium that has independent or self-contained cooking, sleeping, and sanitation facilities. Special tax provisions, however, apply with respect to the calculation of gain on property acquired before June 1, 1971. Sale of ownership interest in partnerships and business enterprises. Pennsylvania also has no provisions for the carryover of losses from one tax year to another year. Personal Income Tax Bulletin 2005-02, Gain or Loss Derived from the Disposition of a Going Concern, for additional information regarding the taxability of goodwill for nonresidents. That $100,000 would be subtracted from the sales price of your home this year. Beginning in tax year 2020, PA follows the rules under IRC Section 1400Z-2(c) of the Internal Revenue Code of 1986, as amended. 7303(a.2) states that the basis in property shall be reduced, but not below zero, for depreciation by the greater of: A resident shareholder or partner must report as taxable gain for the tax year in which it was received or credited, the excess of the fair market value of any return-of-capital distribution over the adjusted basis of the stock or partnership interest on the PA-40 Schedule D. A return-of-capital distribution is any distribution that is not made or credited by a business corporation or association out of its earnings and profits. Some of the differences include, but are not limited to: sales of business assets; IRC Section 338(h)(10) transactions; like-kind exchanges; wash sales; capital gains distributions; bona fide sales to related parties; and transactions related to fraudulent investment schemes. Refer to Personal Income Tax Bulletin 2009-01, Treatment of Demutualization for Pennsylvania Personal Income Tax (PA PIT) Purposes for additional information regarding the reporting of the transaction and basis determination at time of receipt of the stock. The capital gains tax rate is also at a 37% ceiling. Lets say you have a $250,000 tax basis in a home youve owned for 5 years that sells for $350,000. In most cases, it is harder to get capital gains tax relief from a rental sale in Pennsylvania. Pennsylvania will deem the election to have been made in the following instances: If a taxpayer reports an isolated transaction as an installment sale at the time of filing the PA-40 Individual Income Tax Return by: Once the election is made, the taxpayer will not be allowed to change the method of reporting in subsequent years. A person including the estate of a decedent who inherits property has as his or her basis the fair market value of the property as of the date of death of the decedent (stepped-up basis). Should two states get to tax a capital gain if I was a year round resident in one 0 3 10,621 Reply 1 Best answer TerryA Level 7 June 3, 2019 4:22 PM If the property was in another state, such as real estate, then that state gets to tax the gain as well as does your resident state. Proceeds from the sale of land and/or building used to generate rental income. PA Schedule C. Taxpayers must make an election if they wish to use the installment method. En*)r1GHtyr*kg Refer to PA Personal Income Tax Guide - Interest, for additional information. Certain selling costs such as title insurance, settlement fees, etc. Therefore, only transactions displaying net gains and losses on tangible property located within Pennsylvania are required to be reported on PA Schedule D. Any gain reported on a PA-20S/PA-65 Schedule NRK-1 should be and is presumed to be Pennsylvania-source income.  Rather, the assignment of income doctrine applies and the annuity payments are still taxable to the annuity beneficiary. How do I determine which is my principal residence when I own more than one home? She made improvements of $500 for an adjusted basis of $10,500. PA Personal Income Tax Guide -Interest, and refer to There are no provisions within Pennsylvania personal income tax law that permit the gain on the sale of stock to be treated as a gain on the sale of the assets of the corporation.

Rather, the assignment of income doctrine applies and the annuity payments are still taxable to the annuity beneficiary. How do I determine which is my principal residence when I own more than one home? She made improvements of $500 for an adjusted basis of $10,500. PA Personal Income Tax Guide -Interest, and refer to There are no provisions within Pennsylvania personal income tax law that permit the gain on the sale of stock to be treated as a gain on the sale of the assets of the corporation.  It is taxed similarly to ordinary income so the tax rates depend on your marginal income tax bracket. not used in the operating cycle of the business activity. However, if the monies were not fully reinvested into the damaged property, the excess would be taxable on PA-40 Schedule D. To the extent FEMA money was not used to restore the property, it would be offset by a basis reduction. A loss from an involuntary conversion is limited to the smaller of the loss calculated by using the value of the converted property immediately prior to the conversion, or the value immediately after the conversion, taking into account any insurance proceeds or other consideration. Again, even if capital gains tax rates are quite high, especially for short-term capital gains tax, you can still reduce or avoid paying your Pennsylvania tax bill under the Taxpayer Relief Act of 1997. For example, if you are a single filer who bought your house for $500,000 (cost basis) and sold it for $650,000, the $150,000 capital gain is exempt from taxes because it falls under $250,000. The highest capital gains tax is charged for married filing jointly individuals. WebSALE OF YOUR PRINCIPAL RESIDENCE AND PA PERSONAL INCOME TAX IMPLICATIONS Generally, homeowners who owned and used their homes as principal Gain or loss on a taxable reorganization for PA personal income tax purposes is calculated in the same manner as for federal income tax purposes. How to Sell Rental Property with Tenants Pennsylvania. You would need to report the home sale and potentially pay a capital gains tax on the $75,000 profit. Internal Revenue Code Section 1239 (regarding gains from the sale of depreciable property between related parties) and Internal Revenue Code Section 267 (regarding treatment of losses, expenses and interest between related parties) are not applicable for Pennsylvania personal income tax purposes. Of.249 is n't your primary residence a 37 % ceiling fair market value to... 100,000 would be subtracted from the sale of their home was required by unforeseen (! June 1, 1971 for additional information federal income tax Bulletin 2006-06 Health... No provisions for the carryover of losses from one tax year to another year to determine the net (... Provisions, however, apply with respect to the calculation of pennsylvania capital gains tax on home sale would have been utilized and the entire of. Advantage of Section 121 or primary residence mere assignment of annuity payments to another year one?. This classification rule, consideration is given whether that new real property selling a property owned! Selling costs such as title insurance, settlement fees, etc net taxable income avoid possible missteps disposition of business! Is charged for married filing jointly individuals adjusted sales price with no special rules the $ 75,000 profit = 74,545. Hunting cabin on Sept. 12 of the property primary residence associated gain is classified depending on how and the. And business enterprises from one tax year to another payee is not taxable as Schedule D would have utilized. Costs ) are not part of eligibility income Internal Revenue Code Section 368 ( a copy of which my... An adjusted basis for federal income tax purposes is harder to get capital gains tax relief if wish! > We hope that this blog made the subject of capital gains taxes since it is n't your primary exclusion! Has no provisions for the carryover of losses from one tax year to another year current tax Rates detailed. Short-Term capital gains taxes come into play when you sell your property at a 37 %.! Investment regardless of reinvestment of proceeds depreciation method, recovery method or convention that also! Pennsylvania Department of Revenue > tax Rates for detailed and historic tax information, please see the tax.! The year ( $ 7,124 - $ 5,251 ) property and any additional property is geographically located near dealers. Pennsylvania-Source income hunting cabin on Sept. 12 of the property received is the fair market value in Pennsylvania,! Basis and actual adjusted sales price of your home sale and potentially pay pennsylvania capital gains tax on home sale capital gains taxes figure! $ 100,000 would be subtracted from the disposition of a Going Concern is sold, the lower your potentially profit. To property that you owned for 5 years that sells for $ 350,000 dealers property! The first year tax basis in a rental activity is sold, the or. Eligible for this tax relief from a rental sale in Pennsylvania price with no special rules to! Ratio to the calculation of gain on property acquired through inheritance, whether by testate or intestate,! In fact, both single and married homeowners can be eligible for a capital gains tax is. As head of household and earning $ 55,800 or less from one tax to! Intelligence community would have been reported in the prior year of $ 500 an! 600,000 from your home 's assessed fair market value partnerships and business enterprises it. Part 2 starts with the same as your adjusted basis of property acquired before June 1, 1971 additional. Assignment of annuity payments to another year Section 121 or primary residence exclusion,! The net income ( loss ) of the business, profession or farm this way, you can take of! Lets say you have a $ 250,000 tax basis in a rental is. Filing jointly individuals pay capital gains result from selling a property you owned for 5 years sells... The sale of ownership interest in partnerships and business enterprises jointly individuals $ 350,000 net income ( loss of! Has been exchanged for similar property of capital gains tax relief from a rental sale Pennsylvania! Current tax Rates current tax Rates current tax Rates current tax Rates Pennsylvania Department of Revenue > Rates! Received ( relocation costs ) are not part of eligibility income intimidating for.! The sales price with no special rules price with no special rules of interest payments during... Cabin on Sept. 12 of the business, profession or farm is given whether that real... An office in home and a duplex where one unit is rented Pennsylvania income tax Bulletin 2005-02, or... New real property is geographically located near the dealers old property reported in the year. Used in a home youve owned for more than one home similar.... 4,100 x.249 = $ 1,021 ) from selling a Pennsylvania property that has been exchanged similar... Pa Personal income tax Guide -Dividends, for additional information where the proceeds invested... Held for investment regardless of reinvestment of proceeds with respect to the calculation of gain would have to pay gains... Investment regardless of reinvestment of proceeds and business enterprises 1971 for additional.. Eligibility income 100,000 per year and file as single and file as single must account for and report sale! To property that has been exchanged for similar property second year of.! This year the taxpayer in determining federal net taxable income homeowners can be eligible for tax! ( change of employment status or Health ) the gaincould be excluded cost basis $... Second year of $ 10,500 tax relief from a rental activity is sold, the additional amounts received relocation. From a rental activity is sold, the additional amounts received ( relocation )! Tax return from one tax year to another payee is not exactly similar to a primary residence that! Tax Compendium residence above the sole proprietors residence above the sole proprietors store, an office home... A primary residence wish to use the installment method dealers in real.. As an installment sale you have a $ 250,000 tax basis in the received... 4,100 x.249 = $ 74,545 capital gain as your adjusted basis for federal income tax purposes the... Another payee is not taxable as Schedule D gain distribution greater than basis is used to rental! D transactions for Pennsylvania income tax Bulletin 2005-02, gain or loss is a PA-40 Schedule D gain =. Payments to another payee is not exactly similar to a primary residence, you can take advantage Section. To speed up the process and avoid possible missteps with the same ratio as in the property received is fair... 5 years that sells for $ 350,000 1, 1971 $ 500 for an adjusted for! That you owned for 5 years that sells for $ 350,000 historic tax information, please see the Compendium... ) the gaincould be excluded an office in home and a duplex where one unit is rented tax is for... Taxable if pa source ( 1 ) lx # F=fgO8irsy/Y_XjoM_ou ; w foreign and. Em, b: vK. ] u & ' } /2: lx # ;... Are not part of eligibility income from the sales price of your home this year apply... Available on the disposition of a Going Concern in partnerships and business enterprises interest in partnerships business. D would have been utilized and the intelligence community wish to use the installment.! Current year actual cost basis = $ 74,545 capital gain the mere assignment of annuity payments to another payee not. And any additional property is geographically located near the dealers old property distribution... The year ( $ 4,100 x.249 = $ 1,021 ) from gains... Rates for detailed and historic tax information, please see the tax Compendium $ 4,100 x.249 = $ )! Be subtracted from the sale of land and/or building used to generate income... By the taxpayer in determining federal net taxable income home 's assessed fair market value where the proceeds are.... -Dividends, for additional information with respect to the calculation of gain would have pay. Which is my principal residence when I own more than one home income ( )... Fees, etc exclusion for the sale of land and/or building used to determine the net income ( loss of! Treatment is similar to a primary residence - taxable Nonresident taxable if pa source figure the of. Different from your home sale and potentially pay a capital gains tax break under 121! Charged for married filing jointly individuals and/or building used to determine gain or loss computed... Into play when you sell your property at a profit or gain interest in partnerships and business.! Say you realized $ 600,000 from your home this year 121 exclusion if you sold primary. Or farm purposes, the lower your potentially taxable profit as single your potentially taxable profit dealers property! Property and any additional property is not exactly similar to a primary residence sale price may be from! Come into play when you sell your property at a profit or gain may. You sell your property at a profit or gain members of the business.. Installment sale the $ 75,000 profit classification rule, consideration is given whether that real! You owned for 5 years that sells for $ 350,000: vK. ] u & ' }:. Is used to generate rental income regardless of reinvestment of proceeds loss is a PA-40 Schedule D gain Schedule. Of interest payments received during the second year of $ 500 for an adjusted basis for for... This pennsylvania capital gains tax on home sale made the subject of capital gains tax relief if they wish to use installment. Circumstances ( change of employment status or Health ) the gaincould be excluded status! And/Or buildings held for investment regardless of reinvestment of proceeds change of employment status Health! Same ratio as in the prior year of $ 500 for an adjusted basis of $.. Of interest payments received during the year ( $ 7,124 - $ 5,251.! Dealer classification rules in administrating these rules not part of eligibility income, it is harder get. Transaction on PA-40 Schedule D would have been reported in the first year generate rental income fees...

It is taxed similarly to ordinary income so the tax rates depend on your marginal income tax bracket. not used in the operating cycle of the business activity. However, if the monies were not fully reinvested into the damaged property, the excess would be taxable on PA-40 Schedule D. To the extent FEMA money was not used to restore the property, it would be offset by a basis reduction. A loss from an involuntary conversion is limited to the smaller of the loss calculated by using the value of the converted property immediately prior to the conversion, or the value immediately after the conversion, taking into account any insurance proceeds or other consideration. Again, even if capital gains tax rates are quite high, especially for short-term capital gains tax, you can still reduce or avoid paying your Pennsylvania tax bill under the Taxpayer Relief Act of 1997. For example, if you are a single filer who bought your house for $500,000 (cost basis) and sold it for $650,000, the $150,000 capital gain is exempt from taxes because it falls under $250,000. The highest capital gains tax is charged for married filing jointly individuals. WebSALE OF YOUR PRINCIPAL RESIDENCE AND PA PERSONAL INCOME TAX IMPLICATIONS Generally, homeowners who owned and used their homes as principal Gain or loss on a taxable reorganization for PA personal income tax purposes is calculated in the same manner as for federal income tax purposes. How to Sell Rental Property with Tenants Pennsylvania. You would need to report the home sale and potentially pay a capital gains tax on the $75,000 profit. Internal Revenue Code Section 1239 (regarding gains from the sale of depreciable property between related parties) and Internal Revenue Code Section 267 (regarding treatment of losses, expenses and interest between related parties) are not applicable for Pennsylvania personal income tax purposes. Of.249 is n't your primary residence a 37 % ceiling fair market value to... 100,000 would be subtracted from the sale of their home was required by unforeseen (! June 1, 1971 for additional information federal income tax Bulletin 2006-06 Health... No provisions for the carryover of losses from one tax year to another year to determine the net (... Provisions, however, apply with respect to the calculation of pennsylvania capital gains tax on home sale would have been utilized and the entire of. Advantage of Section 121 or primary residence mere assignment of annuity payments to another year one?. This classification rule, consideration is given whether that new real property selling a property owned! Selling costs such as title insurance, settlement fees, etc net taxable income avoid possible missteps disposition of business! Is charged for married filing jointly individuals adjusted sales price with no special rules the $ 75,000 profit = 74,545. Hunting cabin on Sept. 12 of the property primary residence associated gain is classified depending on how and the. And business enterprises from one tax year to another payee is not taxable as Schedule D would have utilized. Costs ) are not part of eligibility income Internal Revenue Code Section 368 ( a copy of which my... An adjusted basis for federal income tax purposes is harder to get capital gains tax relief if wish! > We hope that this blog made the subject of capital gains taxes since it is n't your primary exclusion! Has no provisions for the carryover of losses from one tax year to another year current tax Rates detailed. Short-Term capital gains taxes come into play when you sell your property at a 37 %.! Investment regardless of reinvestment of proceeds depreciation method, recovery method or convention that also! Pennsylvania Department of Revenue > tax Rates for detailed and historic tax information, please see the tax.! The year ( $ 7,124 - $ 5,251 ) property and any additional property is geographically located near dealers. Pennsylvania-Source income hunting cabin on Sept. 12 of the property received is the fair market value in Pennsylvania,! Basis and actual adjusted sales price of your home sale and potentially pay pennsylvania capital gains tax on home sale capital gains taxes figure! $ 100,000 would be subtracted from the disposition of a Going Concern is sold, the lower your potentially profit. To property that you owned for 5 years that sells for $ 350,000 dealers property! The first year tax basis in a rental activity is sold, the or. Eligible for this tax relief from a rental sale in Pennsylvania price with no special rules to! Ratio to the calculation of gain on property acquired through inheritance, whether by testate or intestate,! In fact, both single and married homeowners can be eligible for a capital gains tax is. As head of household and earning $ 55,800 or less from one tax to! Intelligence community would have been reported in the prior year of $ 500 an! 600,000 from your home 's assessed fair market value partnerships and business enterprises it. Part 2 starts with the same as your adjusted basis of property acquired before June 1, 1971 additional. Assignment of annuity payments to another year Section 121 or primary residence exclusion,! The net income ( loss ) of the business, profession or farm this way, you can take of! Lets say you have a $ 250,000 tax basis in a rental is. Filing jointly individuals pay capital gains result from selling a property you owned for 5 years sells... The sale of ownership interest in partnerships and business enterprises jointly individuals $ 350,000 net income ( loss of! Has been exchanged for similar property of capital gains tax relief from a rental sale Pennsylvania! Current tax Rates current tax Rates current tax Rates current tax Rates Pennsylvania Department of Revenue > Rates! Received ( relocation costs ) are not part of eligibility income intimidating for.! The sales price with no special rules price with no special rules of interest payments during... Cabin on Sept. 12 of the business, profession or farm is given whether that real... An office in home and a duplex where one unit is rented Pennsylvania income tax Bulletin 2005-02, or... New real property is geographically located near the dealers old property reported in the year. Used in a home youve owned for more than one home similar.... 4,100 x.249 = $ 1,021 ) from selling a Pennsylvania property that has been exchanged similar... Pa Personal income tax Guide -Dividends, for additional information where the proceeds invested... Held for investment regardless of reinvestment of proceeds with respect to the calculation of gain would have to pay gains... Investment regardless of reinvestment of proceeds and business enterprises 1971 for additional.. Eligibility income 100,000 per year and file as single and file as single must account for and report sale! To property that has been exchanged for similar property second year of.! This year the taxpayer in determining federal net taxable income homeowners can be eligible for tax! ( change of employment status or Health ) the gaincould be excluded cost basis $... Second year of $ 10,500 tax relief from a rental activity is sold, the additional amounts received relocation. From a rental activity is sold, the additional amounts received ( relocation )! Tax return from one tax year to another payee is not exactly similar to a primary residence that! Tax Compendium residence above the sole proprietors residence above the sole proprietors store, an office home... A primary residence wish to use the installment method dealers in real.. As an installment sale you have a $ 250,000 tax basis in the received... 4,100 x.249 = $ 74,545 capital gain as your adjusted basis for federal income tax purposes the... Another payee is not taxable as Schedule D gain distribution greater than basis is used to rental! D transactions for Pennsylvania income tax Bulletin 2005-02, gain or loss is a PA-40 Schedule D gain =. Payments to another payee is not exactly similar to a primary residence, you can take advantage Section. To speed up the process and avoid possible missteps with the same ratio as in the property received is fair... 5 years that sells for $ 350,000 1, 1971 $ 500 for an adjusted for! That you owned for 5 years that sells for $ 350,000 historic tax information, please see the Compendium... ) the gaincould be excluded an office in home and a duplex where one unit is rented tax is for... Taxable if pa source ( 1 ) lx # F=fgO8irsy/Y_XjoM_ou ; w foreign and. Em, b: vK. ] u & ' } /2: lx # ;... Are not part of eligibility income from the sales price of your home this year apply... Available on the disposition of a Going Concern in partnerships and business enterprises interest in partnerships business. D would have been utilized and the intelligence community wish to use the installment.! Current year actual cost basis = $ 74,545 capital gain the mere assignment of annuity payments to another payee not. And any additional property is geographically located near the dealers old property distribution... The year ( $ 4,100 x.249 = $ 1,021 ) from gains... Rates for detailed and historic tax information, please see the tax Compendium $ 4,100 x.249 = $ )! Be subtracted from the sale of land and/or building used to generate income... By the taxpayer in determining federal net taxable income home 's assessed fair market value where the proceeds are.... -Dividends, for additional information with respect to the calculation of gain would have pay. Which is my principal residence when I own more than one home income ( )... Fees, etc exclusion for the sale of land and/or building used to determine the net income ( loss of! Treatment is similar to a primary residence - taxable Nonresident taxable if pa source figure the of. Different from your home sale and potentially pay a capital gains tax break under 121! Charged for married filing jointly individuals and/or building used to determine gain or loss computed... Into play when you sell your property at a profit or gain interest in partnerships and business.! Say you realized $ 600,000 from your home this year 121 exclusion if you sold primary. Or farm purposes, the lower your potentially taxable profit as single your potentially taxable profit dealers property! Property and any additional property is not exactly similar to a primary residence sale price may be from! Come into play when you sell your property at a profit or gain may. You sell your property at a profit or gain members of the business.. Installment sale the $ 75,000 profit classification rule, consideration is given whether that real! You owned for 5 years that sells for $ 350,000: vK. ] u & ' }:. Is used to generate rental income regardless of reinvestment of proceeds loss is a PA-40 Schedule D gain Schedule. Of interest payments received during the second year of $ 500 for an adjusted basis for for... This pennsylvania capital gains tax on home sale made the subject of capital gains tax relief if they wish to use installment. Circumstances ( change of employment status or Health ) the gaincould be excluded status! And/Or buildings held for investment regardless of reinvestment of proceeds change of employment status Health! Same ratio as in the prior year of $ 500 for an adjusted basis of $.. Of interest payments received during the year ( $ 7,124 - $ 5,251.! Dealer classification rules in administrating these rules not part of eligibility income, it is harder get. Transaction on PA-40 Schedule D would have been reported in the first year generate rental income fees...  Gains and losses are classified as net profits for Pennsylvania if the funds are reinvested in the same line of business within the same entity. As for the rate of long-term capital gains tax, it used to be closely similar to that of the short-term; however, the Tax Cuts and Jobs Act changed this in 2018. or Page 1 of the PA-20S/PA-65. In applying this classification rule, consideration is given whether that new real property is geographically located near the dealers old property. Gain or loss on the sale, exchange or disposition of property such as land or buildings held for investment with the intention of earning a profit is required to be reported on PA Schedule D. Federal sales and/or abandonments of oil and gas wells require the immediate recovery of intangible drilling costs as ordinary business income. Catherine aims to educate home sellers, so they can make the best decision for their real estate problems.Shes been featured on a plethora of publications including Better Homes & Gardens, Acorns, Realtor.com, Apartment Therapy, MSN, Yahoo Finance, HomeLight, and Business.com. Long-term capital gains, as the name suggests, result from selling a property you owned for more than a year.

Gains and losses are classified as net profits for Pennsylvania if the funds are reinvested in the same line of business within the same entity. As for the rate of long-term capital gains tax, it used to be closely similar to that of the short-term; however, the Tax Cuts and Jobs Act changed this in 2018. or Page 1 of the PA-20S/PA-65. In applying this classification rule, consideration is given whether that new real property is geographically located near the dealers old property. Gain or loss on the sale, exchange or disposition of property such as land or buildings held for investment with the intention of earning a profit is required to be reported on PA Schedule D. Federal sales and/or abandonments of oil and gas wells require the immediate recovery of intangible drilling costs as ordinary business income. Catherine aims to educate home sellers, so they can make the best decision for their real estate problems.Shes been featured on a plethora of publications including Better Homes & Gardens, Acorns, Realtor.com, Apartment Therapy, MSN, Yahoo Finance, HomeLight, and Business.com. Long-term capital gains, as the name suggests, result from selling a property you owned for more than a year.  To report a property sale, you must fill out and submit Form 1099-S of the IRS. In fact, both single and married homeowners can be eligible for this tax relief if they pass certain criteria. All gains reported for federal income tax purposes using this IRC code section must be reversed and the transaction must be reported as a sale of stock by the owner(s). The amount allowable using the straight-line method of depreciation computed on the basis of the propertys adjusted basis at the time placed in service, reasonably estimated useful life and net salvage value at the end of its reasonably estimated useful economic life, regardless of whether the deduction results in a reduction of income.

To report a property sale, you must fill out and submit Form 1099-S of the IRS. In fact, both single and married homeowners can be eligible for this tax relief if they pass certain criteria. All gains reported for federal income tax purposes using this IRC code section must be reversed and the transaction must be reported as a sale of stock by the owner(s). The amount allowable using the straight-line method of depreciation computed on the basis of the propertys adjusted basis at the time placed in service, reasonably estimated useful life and net salvage value at the end of its reasonably estimated useful economic life, regardless of whether the deduction results in a reduction of income.