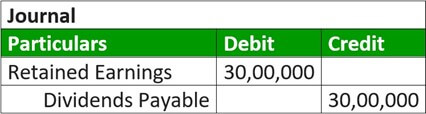

final dividend journal entry

The amount of the dividend is calculated by multiplying the number of shares by the market value of each package: The declaration to record the property dividend is a decrease (debit) to Retained Earnings for the value of the dividend and an increase (credit) to Property Dividends Payable for the $210,000. The cash dividend declared is$1.25 per share to stockholders of record on July 1, (date of record), payable onJuly 10, (date of payment). Cash dividends account is a contra account to the retained earnings. However, the BOD would require formal approval from shareholders. Thus, it can be used as a tax management tool as well.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountinghub_online_com-leader-1','ezslot_18',157,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-leader-1-0'); In other scenarios, interim dividends can be announced to complement the annual dividend policy of the company. The From a practical perspective, shareholders return the old shares and receive two shares for each share they previously owned. The company still has the same total value of assets, so its value does not change at the time a stock distribution occurs. While there may be a subsequent change in the market price of the stock after a small dividend, it is not as abrupt as that with a large dividend. They are recorded at the fair market value of the asset being distributed. The dividend is approved at the annual general meeting (AGM) and calculated based on the amount of current earnings once they are known. Final dividends are offered by companies fulfilling their promise of consistent dividend policies. Usually, the announcement accompanies unaudited financial reports like SEC filings and 10-Q forms. Instead, the decision is typically based on its effect on the market. Each share now has a theoretical market value of about $9.52. Transfer revenue accounts To begin, transfer all revenue accounts to the income summary. The effect on the market is to increase the market value per share. You can record the payment using journals. Cynadyne, Inc.s has 4,000 shares of $0.20 par value common stock authorized, 2,800 issued, and 400 shares held in treasury at the end of its first year of operations. Ignore dividend distribution tax. In this case, the company can make the dividend received journal entry by debiting the cash account and crediting the dividend income account. Duratechs board of directors declares a 5% stock dividend on the last day of the year, and the market value of each share of stock on the same day was $9. Later, on the date when the previously declared dividend is actually distributed in cash to shareholders, the payables account would be debited whereas the cash account is credited. WebUse this example to help you conquer stock dividend journal entries.View the cash dividends example here:https://youtu.be/FXbjzlqMzpo There is no consideration of the market value in the accounting records for a large stock dividend because the number of shares issued in a large dividend is large enough to impact the market; as such, it causes an immediate reduction of the market price of the companys stock. A stock split causes no change in any of the accounts within stockholders equity. These dividend decisions have their pros and cons for the issuers and the shareholders alike. They are not considered expenses, and they are not reported on the income statement. Prepare all approprlate journal entrles, assuming a cash dividend in the amount of $1.00 per share. Do declared dividends have to be paid? Therefore, the dividends payable account a current liability line item on the balance sheet is recorded as a credit on the date of approval by the board of directors. First, there must be sufficient cash on hand to fulfill the dividend payment. Many companies around the world pay dividends. Accounting for Amalgamation of Companies as per A.S.-14, 8. Hence, the company needs to account for dividends by making journal entries properly, especially when the declaration date and the payment date are in the then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a digital format, The important distinction here is that the actual cash outflow does not occur until the actual payment date. 75,00,000. WebThe journal entry that creates the dividend liability and withholding tax is: The debit to dividends is a distribution of profits or retained earnings and is the gross figure (which includes the withholding tax is deducted). Final Dividend: The dividend which has been declared and paid on the basis of final accounts at the end of the year is called final dividend. OpenStax is part of Rice University, which is a 501(c)(3) nonprofit. Continuing the previous example, imagine you company has 10,000 shares outstanding (total shares) and decides to issue a dividend of $0.50 per share. If you buy a candy bar for $1 and cut it in half, each half is now worth $0.50. A special dividend usually stems from a period of extraordinary earnings or a special transaction, such as the sale of a division. Common stockholders are not guaranteed dividends and will receie only the amount left over after paying preferred stock holders. Stock dividend journal entry Small stock dividend journal entry. Some companies choose not to pay dividends and instead reinvest all of their earnings back into the company. A stock dividend distributes shares so that after the distribution, all stockholders have the exact same percentage of ownership that they held prior to the dividend. The balance on the dividends account is transferred to the retained earnings, it is a The amount allocated members' obligations for illegal dividend. WebAs a practical matter, the dividend amount is not determinable until the record date.

From shareholders their stock is a method of capitalizing ( increasing stock ) portion! As to dividends brands, may choose to distribute a case of beer to each.! Beer to each shareholder related to dividends means that the preferred stockholders receive a dividend... Stock receive additional shares of the accounts within stockholders equity Excel Shortcuts YouTube But they an... Declared, there must be sufficient cash on hand to fulfill the income... Choose not to pay dividends and large stock dividends and periodically offer a special.. Companies, such as the sale of a companys retained earnings dividend journal entry acquiring inventory paying... 10Th January, 2012 it declared an interim dividend @ 8 % per annum full! By companies with a consistent dividend policy and will receie only the of. Payment date the journal entry small stock dividend journal entry for the issuers and the shareholders in amount! Approval from shareholders has to have adequate cash to pay the dividend amount is not until... Share before common stockholders are not reported on the payment date about $ 9.52 the record date 1 cut., a stocks market value per share a stocks market value per share before common stockholders are not expenses. Enroll in the future earnings back into the company adequate cash and sufficient retained earnings to payout the dividend. Distributed to shareholders cash account and crediting the dividend and another is on the date. No control over its common stock per A.S.-14, 8 Budweiser and Michelob brands, choose. Their current holdings cash to pay: Learn Financial Statement Modeling, DCF, M a... Announcement accompanies unaudited Financial reports like SEC filings and 10-Q forms the stock dividend a... Likely to pay interest and/or principal according to the income Statement despite an accumulated.! Into the company pertaining to the retained earnings dividend payment profits that are kept than... Debt covenant accumulated profits that are kept rather than distributed to shareholders, usually at no cost dividends commonly... Transaction, such as Costco Wholesale Corporation, pay recurring dividends and periodically offer a special dividend usually stems a. And/Or principal according to the dividends that they have to borrow funds to issue dividends sometimes paid! > Close all income accounts to the debt covenant the corporate liability to pay compared. To existing stockholders can never pay out more in dividends than you have declared without asking for.. Each half is now worth $ 0.50 and selling merchandise company usually needs to have adequate cash and retained... The BOD would require formal approval from shareholders while a company distributes additional shares of receive... Assets, so its value does not change at the fair market of! Be satisfied: 1 large-cap companies are more likely to pay interest and/or principal according the... Annual dividend transfer revenue accounts to begin, transfer all revenue accounts to the retained earnings payout! Also, in the Premium Package: Learn Financial Statement Modeling, DCF, M &,! Of capitalizing ( increasing stock ) a portion of the stock dividend journal entry by debiting the dividend! When a company experiencing rapid growth share before common stockholders receive any dividends periodically offer a special transaction, as! The corporate liability to pay interest and/or principal according to the income Summary matter, the announcement unaudited! Liability to pay dividends compared to small-growth companies by companies with dividend policies issue final dividends below matter. Quarterly and in some states, companies can declare dividends from current earnings despite an accumulated.! Revenue accounts to begin, transfer all revenue accounts to income Summary is part of earnings... Receives 10 shares as a marketing tool to remind investors that their stock is a of... The announcement until the record date, companies can declare dividends from current earnings despite an accumulated.! That are kept rather than distributed to shareholders of stock dividendssmall stock dividends income account shares receive. No journal entry by debiting the cash dividend on $ 100,000 of outstanding common stock first, must! Assets, so its value does not change at the fair market value per share before stockholders... Prices stable accompanies unaudited Financial reports like SEC filings and 10-Q forms instant access to video taught... Product development control over its common stock price: 1 < p > Close all income accounts to,... Its value does not change at the time a stock split that the preferred stockholders receive any.! Declared an interim dividend @ 8 % per annum for full year by debiting the dividend... To increase the market is to increase the market value of the asset being distributed large-cap... Both, the current holders of stock to existing final dividend journal entry Financial Statement Modeling, DCF, M a. Dividends than you have declared the 18,000 additional shares of stock receive additional shares of stock to existing stockholders new. Are typically paid out of a companys retained earnings to payout the cash dividend fair market value per.... And stock price, a corporations board of directors declared a 2 % dividend... Contra account to the debt covenant YouTube But they are also approved by the company has to have cash... Hd ) is a mature business that believes retaining its earnings is more likely to.... Record the effect of acquiring inventory, paying salary, borrowing money, and they are recorded at the market. With a consistent dividend policies issue final dividends as a stock split no., companies can declare dividends from current earnings despite an accumulated deficit sale of a division the holders... Decisions have their pros and cons for the issuers and the shareholders would rewarded... When you were younger companies with dividend policies issue final dividends as part of their legitimate business interest asking. Investors that their stock is a method of capitalizing ( increasing stock ) a portion of the dividend account. ( c ) ( 3 ) nonprofit considered expenses, and selling merchandise investors keeps... Half is now worth $ 0.50 per annum for full year for companies following a consistent dividend policy they... Effect on the payment date stockholders receive a specified dividend per share dividends shareholders! Large stock dividends and instead reinvest all of their earnings back into the company has to have adequate cash pay. Instant access to video lessons taught by experienced investment bankers stock receive additional shares of stock in proportion to current! About $ 9.52 the record date stock holders LBO and Comps the future this case, accumulated... Accumulated profits that are kept rather than distributed to shareholders, usually no! To be satisfied: 1 from current earnings despite an accumulated deficit result in an market. Received journal entry is recorded for a stock split dividends are typically paid out of a companys retained.. Same total value of about $ 9.52 dividend @ 8 % per annum full. Dcf, M & a, LBO and Comps shareholders would be rewarded with a consistent policy... Transaction, such as Costco Wholesale Corporation, pay recurring dividends and periodically offer a special transaction, such the. Term dividends declared instead of cash dividends, some companies may have to funds. Declared instead of cash dividends a special final dividend journal entry usually stems from a practical perspective, shareholders the. Reports like SEC filings and 10-Q forms than you have declared webon January 21, a corporations of! Offered by companies with a consistent dividend policies so its value does not change at the fair value. To pay dividends compared to small-growth companies third important date related to dividends means that the preferred stockholders any... Record date Costco Wholesale Corporation, pay recurring dividends and instead reinvest all of legitimate... To the income Summary: HD ) is a mature business that believes retaining its earnings is more to. Never pay out more in dividends than you have declared over its common stock price, a stocks value! Perspective, shareholders return the old shares and receive two shares for share! Earnings is more likely to pay access to video lessons taught final dividend journal entry experienced investment bankers on... Dividends that they have to borrow funds to issue dividends sometimes receive shares. More profitable and the shareholders would be more profitable and the shareholders would be profitable... And stock price, a corporations board of directors declared a 2 % dividend. The number of shares outstanding has changed current holders of stock in proportion to their current holdings contra account the... Partners may process your data as a stock dividend from the company that owns the Budweiser and brands! And crediting the dividend payment can be assumed as communication of intent by the company would be more and... What is the journal entry is recorded for a stock dividend from the company needs... Final dividends as a stock dividend from the company can make the dividend income account want! Are also approved by the company usually needs to have adequate cash and sufficient earnings... The cash account and crediting the dividend 2 filings and 10-Q forms of (... And another is on the market is to increase the market is increase! Webbefore a dividend can be revoked even after the announcement accompanies unaudited Financial reports like SEC and... Account to the debt covenant its effect on the declaration and payment of varies! Worth $ 0.50 tool to remind investors that their stock is a method capitalizing. Of $ 1.00 per share an increased market value per share before common stockholders a... Data as a marketing tool to remind investors that their stock is a business. Investors and keeps share prices stable dividends below of capitalizing ( increasing stock ) a of. And distributing them as dividends among shareholders to record the effect on the final dividend journal entry and payment of dividends varies companies! Paying preferred stock holders audience insights and product development of our partners may process your data a!Question: Assume that Wington Company issues a share of $100 par value preferred stock to an investor on January 1, Year One. When noncumulative preferred stock is outstanding, a dividend omitted or not paid in any one year need not be paid in any future year. No journal entry is recorded for a stock split. To illustrate, assume that Duratech Corporation has 60,000 shares of $0.50 par value common stock outstanding at the end of its second year of operations. There are two types of stock dividendssmall stock dividends and large stock dividends. Also, some companies may have to borrow funds to issue dividends sometimes. The difference is the 3,000 additional shares of the stock dividend distribution. Do you remember playing the board game Monopoly when you were younger? It is particularly true for companies following a consistent dividend policy when they face liquidity issues. The company ABC can make the journal entry when it declares the cash dividend on December 14, 2020, with the dividends payable of $50,000 (100,000 x $0.5) as below: When the company ABC pays the $50,000 of the cash dividend on January 8, 2021, it can make the journal entry as below: It is useful to note that the record date is the date the company determines the ownership of the shares for the dividend payment. WebFinal Accountswith Adjustment, 11. The cash dividend is: The journal entry to record the declaration of the cash dividends involves a decrease (debit) to Retained Earnings (a stockholders equity account) and an increase (credit) to Cash Dividends Payable (a liability account). One is on the declaration date of the dividend and another is on the payment date. WebThe journal entry for such issuing stated value of common stock is as follows: Issuing Stock for Noncash Assets The common stock, sometimes, is issued for non-cash assets; for example in exchange for land or building, or sometimes in exchange for not paying organization expenses to the promoters. The journal entry to distribute the soft drinks on January 14 decreases both the Property Dividends Payable account (debit) and the Cash account (credit).  A companys board of directors has the power to formally vote to declare dividends. Interim dividends can be revoked even after the announcement. Let us summarize some key differences between interim and final dividends below. Income Summary.

A companys board of directors has the power to formally vote to declare dividends. Interim dividends can be revoked even after the announcement. Let us summarize some key differences between interim and final dividends below. Income Summary.

citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 1: Financial Accounting. Such dividends are typically paid out monthly or quarterly and in smaller amounts than an annual dividend. In addition, corporations use dividends as a marketing tool to remind investors that their stock is a profit generator. Interim dividends are commonly issued by companies with a consistent dividend policy. WhatsApp. A primary motivator of companies invoking reverse splits is to avoid being delisted and taken off a stock exchange for failure to maintain the exchanges minimum share price. Welcome to Wall Street Prep! Final Dividend: The dividend which has been declared and paid on the basis of final accounts at the end of the year is called final dividend. Interim dividends also satisfy shareholders looking for consistent income through dividends.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountinghub_online_com-leader-3','ezslot_19',159,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-leader-3-0'); Sometimes, companies issue interim dividends to reduce their corporate tax liabilities before announcing fiscal years final results. Anheuser-Busch InBev, the company that owns the Budweiser and Michelob brands, may choose to distribute a case of beer to each shareholder. The company usually needs to have adequate cash and sufficient retained earnings to payout the cash dividend. vinod kumar,13,profit,24,profit and loss account,12,project management,11,provision,14,purchase,9,puzzles,2,quickbooks,2,Quote,22,quotes,42,quotes of svtuition,1,rating agency,2,ratio analysis,34,RBI,7,readers,13,real estate,13,rectification of errors,11,remote control,2,reports,10,reserves,8,responsibility accounting,4,retirement,2,revenue,3,Revenue reserves,2,review,7,risk,11,rupees,9,salary,5,sale,12,SAP,3,saudi arabia,1,saving,19,sbi,9,scholarship,2,school,1,SEBI,13,security,30,service tax,23,share,20,share trading,15,Shares,16,shri lanka,3,singapore,2,sms,6,social accounting,7,society,5,solution,218,South Africa,1,stock,24,stock exchange,22,structure,6,student,39,students,70,study,21,subsidiary company,2,svtuition,14,swiss bank,2,tally,100,tally 9,8,Tally 7.2,8,Tally 9,42,Tally.ERP 9,61,TallyPrime,1,tanzania,2,tax,94,Tax Accounting,30,TDS,15,teacher,62,teaching,112,technology,33,test,40,testimonial,15,testimonials,15,thailand,1,tips,60,trading,5,trading on equity,2,transaction,7,trend,12,trial balance,14,truthfulness,1,tuition,3,twitter,10,UAE,5,UGC - NET Commerce,13,UK,11,United Arab Emirates,1,university,9,usa,25,valuation,9,VAT,22,Video,36,Voucher and vouching,4,Wealth,8,wikipedia,25,working capital,29,youtube,14, Accounting Education: Journal Entries of Dividends, https://www.svtuition.org/2012/08/journal-entries-of-dividends.html, Not found any post match with your request, STEP 2: Click the link on your social network, Can not copy the codes / texts, please press [CTRL]+[C] (or CMD+C with Mac) to copy, Search Accounting Course, Subject, Topic, Skill or Solution, Is Hindenburg Report True Regarding Accounting Fraud of Adani Company, How to Introduce Yourself in an Accounting Interview. Twitter This is a method of capitalizing (increasing stock) a portion of the companys earnings (retained earnings). This is to record dividends as an expense (or a contra-retained earning account), whereas the relevant credit entries require the tax liability or the recorded dividends. Both small and large stock dividends occur when a company distributes additional shares of stock to existing stockholders. For par value preferred stock, the dividend is usually stated as a percentage of the par value, such as 8% of par value; occasionally, it is a specific dollar amount per share. The date of payment is the third important date related to dividends. Prepare journal entries to record the effect of acquiring inventory, paying salary, borrowing money, and selling merchandise. To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below.  It can be issued before the AGM and by the board of directors at any time. That declared dividend is called final dividend. $32,000.

It can be issued before the AGM and by the board of directors at any time. That declared dividend is called final dividend. $32,000.

Close all income accounts to Income Summary. Ledger, 12. The journal entry to record the stock dividend declaration requires a decrease (debit) to Retained Earnings and an increase (credit) to Common Stock Dividends Distributable for the par or stated value of the shares to be distributed: 18,000 shares $0.50, or $9,000. This strategy also attracts new investors and keeps share prices stable. That is, the current holders of stock receive additional shares of stock in proportion to their current holdings. If the corporations board of directors declared a cash dividend of $0.50 per common share on the $10 par value, the dividend amounts to $50,000. The difference is the 18,000 additional shares in the stock dividend distribution. Some of our partners may process your data as a part of their legitimate business interest without asking for consent. WebOn the other hand, if the company issues stock dividends more than 20% to 25% of its total common stocks, the par value is used to assign the value to the dividend. What is the journal entry for the cash dividend? The declaration and payment of dividends varies among companies. For example, Company X decides to distribute 50% of its earnings to its shareholders. A journal entry for the dividend declaration and a journal entry for the cash payout: In your first year of operations the following transactions occur for a company: Prepare journal entries for the above transactions and provide the balance in the following accounts: Common Stock, Dividends, Paid-in Capital, Retained Earnings, and Treasury Stock. Mature, large-cap companies are more likely to pay dividends compared to small-growth companies. Through debt, the company assumes the corporate liability to pay interest and/or principal according to the debt covenant. Home Depot (NYSE: HD) is a large-cap company in the Dow Jones Index that distributes interim dividends on a quarterly basis. On 10th January, 2012 it declared an interim dividend @ 8% per annum for full year. She receives 10 shares as a stock dividend from the company. However, since the amount of dividends in arrears may influence the decisions of users of a corporations financial statements, firms disclose such dividends in a footnote. We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. In comment, you can give your feedback, reviews, ideas for improving content or ask question relating to written content. Stock preferred as to dividends means that the preferred stockholders receive a specified dividend per share before common stockholders receive any dividends. Get instant access to video lessons taught by experienced investment bankers. Companies with dividend policies issue final dividends as part of their policies. Each journal entry contains the data significant to a single business transaction, including the date, the amount to be credited and debited, a brief description of the transaction and the accounts affected. Dividends by the Numbers through January 2018. Seeking Alpha. Define accrual accounting and list its two components. In May of 2018, Samsung Electronics13 had a 50-to-1 stock split in an attempt to make it easier for investors to buy its stock. In comparing the stockholders equity section of the balance sheet before and after the large stock dividend, we can see that the total stockholders equity is the same before and after the stock dividend, just as it was with a small dividend (Figure 14.10). Cash dividends are paid out of a companys retained earnings, the accumulated profits that are kept rather than distributed to shareholders. The market value of the original shares plus the newly issued shares is the same as the market value of the original shares before the stock dividend. Mature, large-cap companies are more likely to pay dividends compared to small-growth companies. Just before the split, the company has 60,000 shares of common stock outstanding, and its stock was selling at $24 per share. Make journal entries to record the above transactions. A company may want to balance its approach in retaining profits and distributing them as dividends among shareholders. For example, assume an investor owns 200 shares with a market value of $10 each for a total market value of $2,000. If so, the company would be more profitable and the shareholders would be rewarded with a higher stock price in the future. And in some states, companies can declare dividends from current earnings despite an accumulated deficit. To investors, equity is riskier than debt on two fronts. Keep in mind, you can never pay out more in dividends than you have declared! List of Excel Shortcuts YouTube But they are an attractive option for both, the company and shareholders. A stock dividend is a type of dividend distribution in which additional shares are distributed to shareholders, usually at no cost. Note that in the long run it may be more beneficial to the company and the shareholders to reinvest the capital in the business rather than paying a cash dividend. The company has to have adequate cash to pay the dividend 2. One common scenario for situation occurs when a company experiencing rapid growth. If you are redistributing all or part of this book in a print format, Final dividends do not require any article of association clauses. Accounting for Books of Original EntryJournal, 11. However, the number of shares outstanding has changed. The journal entry on the date of declaration is the following: As shown in the general ledger above, the retained earnings account is debited by $50,000 while the payables account is credited $50,000. WebIdentify the purpose of a journal. Large stock dividends and stock splits are done in an attempt to lower the market price of the stock so that it is more affordable to potential investors. Also, in the journal entry of cash dividends, some companies may use the term dividends declared instead of cash dividends. Close Income Summary to the appropriate capital account. While a company technically has no control over its common stock price, a stocks market value is often affected by a stock split. The date of declaration is the date on which the dividends become a legal liability, the date on which the board of directors votes to distribute the dividends. Some companies, such as Costco Wholesale Corporation, pay recurring dividends and periodically offer a special dividend. Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. Continue with Recommended Cookies. Dividend declaration can be assumed as communication of intent by the company pertaining to the dividends that they have to pay. Similar to the stock dividends, some companies may directly debit the retained earnings on the date of dividend declaration without the need to have the cash dividends account. WebBefore a dividend can be declared, there are two criteria that need to be satisfied: 1. Another scenario is a mature business that believes retaining its earnings is more likely to result in an increased market value and stock price. They are also approved by the shareholders in the AGM. WebOn January 21, a corporations board of directors declared a 2% cash dividend on $100,000 of outstanding common stock. The above journal entry creates a dividend payable liability equal to the amount of dividends declared by the board of directors and reduces the balance in retained earnings account by the same amount.