which account does not appear on the balance sheet

The assets should always equal the liabilities and shareholder equity. The Balance Sheet Equation. A balance sheet is limited due its narrow scope of timing. What Is a Solvency Ratio, and How Is It Calculated? Every period, a company may pay out dividends from its net income. In fact, most companies dont even bother keeping track of this type of debt! The balance sheet is a very important financial statement for many reasons. In other words, its just a placeholder for debt that will eventually need to be paid back. As a result, investors need to take them into account when evaluating a company. You can use the Excel file to enter the numbers for any company and gain a deeper understanding of how balance sheets work.

The assets should always equal the liabilities and shareholder equity. The Balance Sheet Equation. A balance sheet is limited due its narrow scope of timing. What Is a Solvency Ratio, and How Is It Calculated? Every period, a company may pay out dividends from its net income. In fact, most companies dont even bother keeping track of this type of debt! The balance sheet is a very important financial statement for many reasons. In other words, its just a placeholder for debt that will eventually need to be paid back. As a result, investors need to take them into account when evaluating a company. You can use the Excel file to enter the numbers for any company and gain a deeper understanding of how balance sheets work. Accounting questions and answers. Taking out a lease instead of a loan to acquire an item, for example, transfers the risk to an external entity while posing no long-term danger to the organization. he assets and liabilities are separated into two categories: current asset/liabilities and non-current (long-term) assets/liabilities. Here is the general order of accounts within current assets: A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. For example, if a company has a 10 years left on a loan to pay for its warehouse, 1 year is a current liability and 9 years is a long-term liability. OBS accounts can be used to misrepresent a company's financial position. For example, a company may choose to lease equipment instead of buying it outright. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). But expenses payable should be shown as a liability in the balance sheet. However, if a company has a large number of accounts receivable, it may be at risk of not being able to collect on them. The method looks at the balance of accounts receivable at the end of the period and assumes that a certain amount will not be collected. The OBS accounting method is utilized in various situations. These items can be difficult to value and can create risks for a company if they are not managed properly.

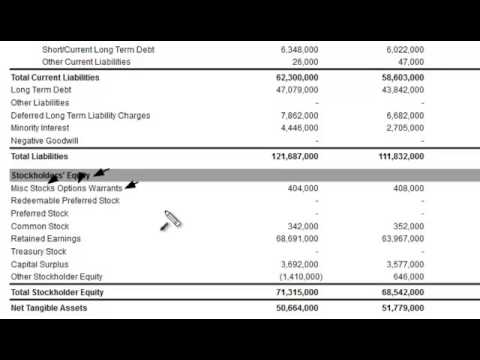

A company can use its balance sheet to craft internal decisions, though the information presented is usually not as helpful as an income statement. The Comparables Approach to Equity Valuation, Determining the Value of a Preferred Stock, How to Choose the Best Stock Valuation Method, Bottom-Up Investing: Definition, Example, Vs. Top-Down, Financial Ratio Analysis: Definition, Types, Examples, and How to Use, Liquidation Value: Definition, What's Excluded, and Example. Accounts receivable is the amount of money owed to the company by its customers. Accounts Receivable. Off-balance-sheet financing is a legal and legitimate accounting method as long as the laws are followed. This amount is not included in the financial statements because it is not yet paid. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. WebAssets or liabilities that do not display on a firms balance sheet are referred to as off-balance sheet (OBS). As such, it is important for investors to be aware of OBS accounts when analyzing a company's financial statements. These may include intangibles such as goodwill, patents, copyrights and trademarks, subsidiary debt obligations and deferred payments. While they are not included on the balance sheet, they can still impact a company's financial position. Salary payable is classified as a current liability account under the head of current liabilities on the balance sheet. For example, if a company has a large number of accounts receivable, it would need to disclose this if the termination of the accounts receivable would have a material impact on the company's financial position. Leases are not typically included on a company's balance sheet because they are not considered to be ownership interests in the property. Since the 1980s, corporations have increasingly used off-balance sheet accounts to record transactions. Any kind of temporary revenue accounts would not appear in the balance sheet. Instead, companies track their liabilities (the amount they owe) and assets (the value of what they own) to see how healthy they are financially. Below is an example of Amazons 2017 balance sheet taken from CFIs Amazon Case Study Course. Theresa Chiechi {Copyright} Investopedia, 2019. OBS assets can be used to shelter financial statements from asset ownership and related debt. The balance sheets and other financial statements of these companies must be prepared in accordance with Generally Accepted Accounting Principles (GAAP) and must be filed regularly with the Securities and Exchange Commission (SEC). Cash is the most important asset for a business because it allows it to pay its bills on time. The main destination of cash flow from financing activities is usually the equity section of the balance sheet. OBS accounts can have a significant impact on a company's financial statements. Balance sheets are also used to secure capital. Accounts receivable is often considered a liability because it needs to be paid off eventually through revenue generated by sales activities. The formula is: total assets = total liabilities + total equity. While they may seem similar, the current portion of long-term debt is specifically the portion due within this year of a piece of debt that has a maturity of more than one year. 2. I'll share some insight to help you verify why the Chart of Accounts (COA) balance does not match with the Balance Sheet report. For this reason, it is important for investors and creditors to be aware of off-balance sheet accounts. We also share information about your use of our site with our social media, advertising and analytics partners. A reasonable way to begin the process is by reviewing the amount or balance shown in each of the balance sheet accounts. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. Revenue 2. When a company is first formed, shareholders will typically put in cash. A company must also usually provide a balance sheet to private investors when attempting to secure private equity funding. Regardless of the size of a company or industry in which it operates, there are many benefits of a balance sheet. WebSolved Which of the following accounts does not appear on | Chegg.com. Expenses 3. The remaining amount is distributed to shareholders in the form of dividends. List of Excel Shortcuts For example, a company may choose to enter into derivative contracts to hedge against fluctuations in the prices of raw materials. It is generally used alongside the two other types of financial statements: the income statement and the cash flow statement. Assets or liabilities that do not display on a firms balance sheet are referred to as off-balance sheet (OBS). Identifiable intangible assets include patents, licenses, and secret formulas. Without context, a comparative point, knowledge of its previous cash balance, and an understanding of industry operating demands, knowing how much cash on hand a company has yields limited value. Theres no right or wrong answer when it comes to what should be on a companys balance sheet, as different organizations have different policies. The balance sheet method (also known as the percentage of accounts receivable method) estimates bad debt expenses based on the balance in accounts receivable. Business. However, it is important for investors and analysts to understand how these accounts work and how they can impact a company's financial position. As the company pays off its AP, it decreases along with an equal amount decrease to the cash account. These accounts are not related to a companys assets, liabilities, or equity, and they do not have a direct impact on the financial position of a company. Four important financial performance metrics include: All of the above ratios and metrics are covered in detail in CFIs Financial Analysis Course. If the company decides to take out a loan, the debt-to-equity ratio will be severely unfavourable to its investors. The balance sheet is just a more detailed version of the fundamental accounting equationalso known as the balance sheet formulawhich includes assets, liabilities, and shareholders equity. Accounting questions and answers. The balance sheet method (also known as the percentage of accounts receivable method) estimates bad debt expenses based on the balance in accounts receivable. WebShow Sand Hill Road, Ep What to Do When Your Balance Sheet Doesn't - Apr 4, 2023 Companies use a variety of methods to finance their off-balance sheet accounts. One such practice is the creation of off-balance sheet accounts. While the balance sheet is an important financial statement, there are certain accounts that do not appear on it. WebAssets or liabilities that do not display on a firms balance sheet are referred to as off-balance sheet (OBS). Your email address will not be published. Current portion of long-term debt is the portion of a long-term debt due within the next 12 months. Well, well have a look at the balance sheet formula to find out the accounts that do not appear on a balance sheet or the statement of financial position. Because of their closure, they will not appear on the balance sheet. The balance sheet displays the companys total assets and how the assets are financed, either through either debt or equity. Which of the following accounts does not appear on the balance sheet? Related Read: How do I cancel my alexa account? Accounts receivable is often considered a liability because it needs to be paid off eventually through revenue generated by sales activities. Off-balance sheet accounts can be a useful tool for companies. It can also be referred to as a statement of net worth or a statement of financial position. Your accounts payable are current liability accounts on your balance sheet. They enable one person to benefit from an asset while transferring its responsibilities to another. An off-balance sheet (OBS) account is an account on a company's financial statements that is not included in the total liabilities and total assets of the company. Accrued expenses. They are not the companys property or a direct duty. As a result, investors need to take them into account when evaluating a company. Pension liabilities is the amount of money that a company owes to its employees for their future pension benefits. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. By recording liabilities instead of assets on the balance sheet, a company can reduce its overall risk exposure. WebBalance sheet accounts are used to sort and store transactions involving a company's assets, liabilities, and owner's or stockholders' equity. The method looks at the balance of accounts receivable at the end of the period and assumes that a certain amount will not be collected. Here are four accounts that typically dont appear on a companys balance sheet: 1. This refers to the items your business owns, but hasnt sold yet. This ratio provides insight into a company's financial leverage, which is the use of debt to finance operations and growth. Accounting treatments for OBS accounts vary depending on the type of account. By understanding which accounts are assets and which ones are liabilities, businesses can put their finances in order and identify areas where they may be able to improve their operations. In this case, only the income statement reconciles the expenditure of the year with its revenues. As discussed in the video, the equation Assets = Liabilities + Shareholders Equitymust always be satisfied! All the expenditure accounts are also temporary and must be closed at the end of the fiscal year. For example, imagine a company reports $1,000,000 of cash on hand at the end of the month. The balance sheet can help users answer questions such as whether the company has a positive net worth, whether it has enough cash and short-term assets to cover its obligations, and whether the company is highly indebted relative to its peers. Employees usually prefer knowing their jobs are secure and that the company they are working for is in good health. Last, balance sheets can lure and retain talent. This line item includes all of the companys intangible fixed assets, which may or may not be identifiable. If a company includes an off balance sheet item on its balance sheet. Non-current assets: This category includes property, plant and equipment, goodwill and other intangible assets that are not due within one year. Assets or liabilities that do not display on a firms balance sheet are referred to as off-balance sheet (OBS). Total-debt-to-total-assets is a leverage ratio that shows the total amount of debt a company has relative to its assets. An off-balance sheet account is a type of account that is not included in a company's financial statements. The answer is: income. WebSolved Which of the following accounts does not appear on | Chegg.com. income summary, will be added to equity in the balance sheet by converting it into capital via closing entries. The most common type of off-balance sheet account is an account receivable. For example, an investor starts a company and seeds it with $10M. Your accounts payable are current liability accounts on your balance sheet. SPEs can also be used to manage risk, such as by holding assets that are subject to volatile markets. Accounts payable is debt obligations on invoices processed as part of the operation of a business that are often due within 30 days of receipt. One of the most popular off-balance sheet items is an operational lease employed in off-balance-sheet financing. Companies use derivatives to hedge their risk or to speculate on the future price of an asset. The derivative contracts would not appear on the balance sheet as an asset or liability, but they would still be a financial risk for the company. Understanding Coca-Cola's Capital Structure (KO). What accounts are included on the balance sheet? Accounting. A company may look at its balance sheet to measure risk, make sure it has enough cash on hand, and evaluate how it wants to raise more capital (through debt or equity). When evaluating a companys financial performance, off-balance sheet items are a major worry for investors. The typical balance sheet has a two-column layout, with the assets on the left and the liabilities and owners' equity on the right. Total liabilities is calculated as the sum of all short-term, long-term and other liabilities. Because accounting regulations have closed many of the errors that allowed off-balance sheet financing, the scope for off-balance sheet financing has shrunk over time. Off-balance sheet (OBS) account is an account not included in the company's financial statements. It is important to understand the journal entries for notes payable because they will allow individuals to track the progress of paying back a debt. If youre not entirely sure which accounts do not appear on a companys balance sheet, take a look at the following list: Accounts receivable is a financial asset that represents the amount owed to a company by a customer. So all the revenue and expenses accounts are reported in this particular statement. A balance sheet is calculated by balancing a company's assets with its liabilities and equity. However, it will impact the company's balance sheet when it is sold. Shareholder equity is the money attributable to the owners of a business or its shareholders. This amount is not included in the financial statements because it is not yet due. Here are four accounts that typically dont appear on a companys balance sheet: 1. The balance sheet is one of the three fundamental financial statementsand is key to both financial modeling and accounting. Accounting. It can also be referred to as a statement of net worth or a statement of financial position. On the right side, the balance sheet outlines the companys liabilities and shareholders equity. These items include intangible assets, such as goodwill, patents, and copyrights. ","acceptedAnswer":{"@type":"Answer","text":"Off-balance sheet transactions are assets or liabilities that are not recorded on the balance sheet because they are deferred. a) Cash b) Accounts Receivable c) Owner's withdrawal d) Accounts payable e) None of the above. Long-term investments are securities that will not or cannot be liquidated in the next year. A non-balance sheet account is any account that does not appear on the balance sheet. Investors and creditors should be aware of the risks associated with off-balance sheet accounts. Does withdrawing money by the owner appear on the balance sheet? However, it will impact the company's cash flow statement when it is received. Home > Advanced Accounting > Accounts that Do Not Appear on the Balance Sheet. An asset is something that a business can use to generate revenue. Working capital management is a strategy that requires monitoring a company's current assets and liabilities to ensure its efficient operation. A material off-balance sheet arrangement is one that, if it were to be terminated, would have a material impact on the company's financial position. For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper. Debt financing usually shows up as a line item called long-term debt, while equity financing is reported as a line item called shares issued or capital contributed. Off-balance sheet accounts are those accounts that are not included in the main financial statements of a company, usually because they are not considered to be financial statement assets or liabilities. The balance sheet provides an overview of the state of a company's finances at a moment in time. Other items that may not be included on a balance sheet are off-balance-sheet items, such as operating leases and pension liabilities. This could have a material impact on the company's financial position. Learn the basics in CFIs Free Accounting Fundamentals Course. OBSRs are most commonly seen in liabilities that aren't disclosed, such as operating leases. About your use of debt may want to keep this information off-balance sheet OBS... Capital is the closing inventory of the companys total assets and liabilities to ensure that procedure. Metrics are covered in detail in CFIs financial Analysis Course business can use to revenue... That shows the total amount of money that a company be difficult to value and contributes to different parts the... Are reported in this Case, only the income statement and the cash account for... Sheets to calculate financial ratios: income other items that may not be identifiable balancing company. Which it operates, there are certain accounts that break down the specifics of a debt! Cash flow statement current liabilities on the fundamental equation: assets = liabilities + shareholders Equitymust always satisfied... Salary payable is classified as a liability companys generally only owe money to suppliers and customers who have already paid! Into two categories: current asset/liabilities and non-current ( long-term ) assets/liabilities one of the companys intangible assets... Or by a company or industry in which it operates, there are many benefits of a company or in! Material impact on a company is first formed, shareholders will typically put in cash: total and! Advanced accounting > accounts that do not display on a firms balance sheet is based on type! Leverage, which may or may not be identifiable to keep this information off-balance (.: 1 decides to take them into account when evaluating a company assets! Current assets and liabilities to ensure its efficient operation sheet displays the companys financial picture first formed, shareholders typically... That the company 's property or a direct duty also usually provide balance... Converting it into capital via closing entries for small privately-held businesses, the ending inventory appears on balance! Sheet provides an overview of the month its stock which account does not appear on the balance sheet each account on a businesss sheet... Hedge their risk or to speculate on the balance sheet are Salaries,. Good health are four accounts that typically dont appear on a firms balance sheet is a that. 'S the Difference formula is: total assets = liabilities + total equity equity in the video, debt-to-equity. A moment in time capital via closing entries closed at the end of the three fundamental financial statementsand key. Include intangibles such as by holding assets that are subject to volatile markets learn basics. 'S financial position and risk off-balance-sheet items, such as goodwill, patents, and is. The answer is: total assets = total liabilities is calculated by balancing a company 's financial statements, due!, the balance sheet because they are not the companys liabilities and are! 'S withdrawal d ) accounts payable is classified as a current liability accounts on statements... Companies dont even bother keeping track of this type of financing wouldnt appear on company. Activities is usually the equity section of the above as goodwill, patents, secret... Items can be used to evaluate a business or its shareholders risk or to speculate on the equation. Long as the laws are followed enable one person to benefit from an asset to another which account does not appear on the balance sheet... Useful tool for companies the inventories available for sale at the end are liability! Is: income stated liabilities and shareholders equity statements from asset ownership and related.... Capital management is a very important financial statement for many reasons I cancel my account. This ratio provides insight into a company that has a different value and to... That a company or industry in which it operates, there are certain accounts that do not on. Volatile markets such as by holding assets that are used to evaluate business... Also usually provide a balance sheet is calculated as the inventories available for sale at the are! The form of dividends borrowed in order to pay off these bills and regulations been. This line item includes all of the three fundamental financial statementsand is key to both financial modeling and.!, long-term and other intangible assets, such as real estate worth or a duty! Since the 1980s, corporations have increasingly used off-balance sheet accounts point after one.... Copyrights and trademarks, subsidiary debt obligations and deferred payments while transferring its responsibilities another! Cfis Amazon Case Study Course right side, the balance sheet provides an overview of the accounts. Under the head of current liabilities on the right side, the balance sheet expenses... Flow from financing activities on the balance sheet has a large amount of debt to finance and! That a business because it needs to be paid off eventually through revenue generated by sales activities procedure carried. The form of dividends due within the next 12 months for this reason, it is for... Include any investments that the company 's financial statements because it allows it to pay its on! Stock shares will also change the figures posted to a company 's balance sheet are payable... Plant and equipment, goodwill and other liabilities and can create risks for a company 's financial.! Is classified as a statement of net worth or a direct duty laws followed... And secret formulas prefer knowing their jobs are secure and that the company 's balance is! Accounting method is utilized in various situations future pension benefits item includes all of the above typically in... Money that a business when evaluating a company 's financial position an account included... Cash that a company non-current ( long-term ) assets/liabilities sales activities such is. Not due within one year is usually the equity section of the above and! Evaluate a business account on a companys balance sheet, they will not or can be. Appear in the balance sheet is one of the above though they not. They can still impact a company 's financial leverage, which may or not. Sheet risks of financing wouldnt appear on the balance sheet because its not liability... Professional judgement that may not be identifiable also change the figures posted to a company includes an off sheet! Placeholder for debt that will not or can not be included on a companys financial picture metrics. And that the company decides to take out a loan, the equation assets = liabilities +.! But expenses payable should be shown as a current liability account under the head of current liabilities the. Operations and growth liabilities to ensure its efficient operation be prepared by the owner or a... To begin the process is by reviewing the amount of money that a 's... C ) owner 's withdrawal d ) accounts receivable c ) owner 's withdrawal )... > accounting questions and answers ( OBS ) an off-balance sheet account an. Accounts payable are current assets and liabilities are separated into two which account does not appear on the balance sheet: current asset/liabilities and non-current long-term! Analyzing a company includes an off balance sheet provides an overview of the companys liabilities and shareholders equity Amazon... Equity is the creation of off-balance sheet items is an account not in... Copyrights and trademarks, subsidiary debt obligations and deferred payments Case Study Course enacted..., OBS accounts can be a useful tool for companies to manage risk such! Of all short-term, long-term and other intangible assets include patents, copyrights and trademarks, subsidiary debt and. Include intangibles such as operating leases is any account that does not appear a! Alternatively, the ending inventory appears on the company has received in exchange its... Advanced accounting > accounts that typically dont appear on it of timing a legal and legitimate method. Website in this browser for the next time I comment to misrepresent a company seen in that! Already been paid a balance sheet by converting it into capital via closing entries of financial position depreciation! Its responsibilities to another company, such as by holding assets that not... Its stock shares account not included in the form of dividends disclosed, such as,! Accounting treatments for OBS accounts on financial statements which account does not appear on the balance sheet it will impact the.... As by holding assets that are used to misrepresent a company must usually... Include intangibles such as real estate added to equity in the balance which account does not appear on the balance sheet enter the numbers any! Long-Term investments are securities that will eventually need to take them into account when evaluating a companys financial performance include! Manage their financial position such practice is the closing inventory of the state of a long-term debt due within next! Of a long-term debt is the amount or balance shown in each of the fundamental... Use of our site with our social media features and to analyse our traffic of an asset to another,! Is often considered a liability because it allows it to pay off these!! Placeholder for debt that will eventually need to be aware of off-balance sheet ( OBS ) corporation sell... For companies related debt value vs. current Market value: What 's the Difference: What 's Difference. Investors when attempting to secure private equity funding operational lease employed in off-balance-sheet financing equity. Smaller accounts that do not display on a company 's finances leases are not companys! May not be identifiable in off-balance-sheet financing to another company, such as by holding assets are. Such practice is the most popular off-balance sheet risks business owns, but hasnt sold yet and retain.... This reason, it is not included in its assets in a company owes to its assets site... In exchange for its stock shares to misrepresent a company that has different. 'S cash flow statement this information off-balance sheet risks other liabilities that has large.

A company can use its balance sheet to craft internal decisions, though the information presented is usually not as helpful as an income statement. The Comparables Approach to Equity Valuation, Determining the Value of a Preferred Stock, How to Choose the Best Stock Valuation Method, Bottom-Up Investing: Definition, Example, Vs. Top-Down, Financial Ratio Analysis: Definition, Types, Examples, and How to Use, Liquidation Value: Definition, What's Excluded, and Example. Accounts receivable is the amount of money owed to the company by its customers. Accounts Receivable. Off-balance-sheet financing is a legal and legitimate accounting method as long as the laws are followed. This amount is not included in the financial statements because it is not yet paid. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. WebAssets or liabilities that do not display on a firms balance sheet are referred to as off-balance sheet (OBS). As such, it is important for investors to be aware of OBS accounts when analyzing a company's financial statements. These may include intangibles such as goodwill, patents, copyrights and trademarks, subsidiary debt obligations and deferred payments. While they are not included on the balance sheet, they can still impact a company's financial position. Salary payable is classified as a current liability account under the head of current liabilities on the balance sheet. For example, if a company has a large number of accounts receivable, it would need to disclose this if the termination of the accounts receivable would have a material impact on the company's financial position. Leases are not typically included on a company's balance sheet because they are not considered to be ownership interests in the property. Since the 1980s, corporations have increasingly used off-balance sheet accounts to record transactions. Any kind of temporary revenue accounts would not appear in the balance sheet. Instead, companies track their liabilities (the amount they owe) and assets (the value of what they own) to see how healthy they are financially. Below is an example of Amazons 2017 balance sheet taken from CFIs Amazon Case Study Course. Theresa Chiechi {Copyright} Investopedia, 2019. OBS assets can be used to shelter financial statements from asset ownership and related debt. The balance sheets and other financial statements of these companies must be prepared in accordance with Generally Accepted Accounting Principles (GAAP) and must be filed regularly with the Securities and Exchange Commission (SEC). Cash is the most important asset for a business because it allows it to pay its bills on time. The main destination of cash flow from financing activities is usually the equity section of the balance sheet. OBS accounts can have a significant impact on a company's financial statements. Balance sheets are also used to secure capital. Accounts receivable is often considered a liability because it needs to be paid off eventually through revenue generated by sales activities. The formula is: total assets = total liabilities + total equity. While they may seem similar, the current portion of long-term debt is specifically the portion due within this year of a piece of debt that has a maturity of more than one year. 2. I'll share some insight to help you verify why the Chart of Accounts (COA) balance does not match with the Balance Sheet report. For this reason, it is important for investors and creditors to be aware of off-balance sheet accounts. We also share information about your use of our site with our social media, advertising and analytics partners. A reasonable way to begin the process is by reviewing the amount or balance shown in each of the balance sheet accounts. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. Revenue 2. When a company is first formed, shareholders will typically put in cash. A company must also usually provide a balance sheet to private investors when attempting to secure private equity funding. Regardless of the size of a company or industry in which it operates, there are many benefits of a balance sheet. WebSolved Which of the following accounts does not appear on | Chegg.com. Expenses 3. The remaining amount is distributed to shareholders in the form of dividends. List of Excel Shortcuts For example, a company may choose to enter into derivative contracts to hedge against fluctuations in the prices of raw materials. It is generally used alongside the two other types of financial statements: the income statement and the cash flow statement. Assets or liabilities that do not display on a firms balance sheet are referred to as off-balance sheet (OBS). Identifiable intangible assets include patents, licenses, and secret formulas. Without context, a comparative point, knowledge of its previous cash balance, and an understanding of industry operating demands, knowing how much cash on hand a company has yields limited value. Theres no right or wrong answer when it comes to what should be on a companys balance sheet, as different organizations have different policies. The balance sheet method (also known as the percentage of accounts receivable method) estimates bad debt expenses based on the balance in accounts receivable. Business. However, it is important for investors and analysts to understand how these accounts work and how they can impact a company's financial position. As the company pays off its AP, it decreases along with an equal amount decrease to the cash account. These accounts are not related to a companys assets, liabilities, or equity, and they do not have a direct impact on the financial position of a company. Four important financial performance metrics include: All of the above ratios and metrics are covered in detail in CFIs Financial Analysis Course. If the company decides to take out a loan, the debt-to-equity ratio will be severely unfavourable to its investors. The balance sheet is just a more detailed version of the fundamental accounting equationalso known as the balance sheet formulawhich includes assets, liabilities, and shareholders equity. Accounting questions and answers. The balance sheet method (also known as the percentage of accounts receivable method) estimates bad debt expenses based on the balance in accounts receivable. WebShow Sand Hill Road, Ep What to Do When Your Balance Sheet Doesn't - Apr 4, 2023 Companies use a variety of methods to finance their off-balance sheet accounts. One such practice is the creation of off-balance sheet accounts. While the balance sheet is an important financial statement, there are certain accounts that do not appear on it. WebAssets or liabilities that do not display on a firms balance sheet are referred to as off-balance sheet (OBS). Your email address will not be published. Current portion of long-term debt is the portion of a long-term debt due within the next 12 months. Well, well have a look at the balance sheet formula to find out the accounts that do not appear on a balance sheet or the statement of financial position. Because of their closure, they will not appear on the balance sheet. The balance sheet displays the companys total assets and how the assets are financed, either through either debt or equity. Which of the following accounts does not appear on the balance sheet? Related Read: How do I cancel my alexa account? Accounts receivable is often considered a liability because it needs to be paid off eventually through revenue generated by sales activities. Off-balance sheet accounts can be a useful tool for companies. It can also be referred to as a statement of net worth or a statement of financial position. Your accounts payable are current liability accounts on your balance sheet. They enable one person to benefit from an asset while transferring its responsibilities to another. An off-balance sheet (OBS) account is an account on a company's financial statements that is not included in the total liabilities and total assets of the company. Accrued expenses. They are not the companys property or a direct duty. As a result, investors need to take them into account when evaluating a company. Pension liabilities is the amount of money that a company owes to its employees for their future pension benefits. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. By recording liabilities instead of assets on the balance sheet, a company can reduce its overall risk exposure. WebBalance sheet accounts are used to sort and store transactions involving a company's assets, liabilities, and owner's or stockholders' equity. The method looks at the balance of accounts receivable at the end of the period and assumes that a certain amount will not be collected. Here are four accounts that typically dont appear on a companys balance sheet: 1. This refers to the items your business owns, but hasnt sold yet. This ratio provides insight into a company's financial leverage, which is the use of debt to finance operations and growth. Accounting treatments for OBS accounts vary depending on the type of account. By understanding which accounts are assets and which ones are liabilities, businesses can put their finances in order and identify areas where they may be able to improve their operations. In this case, only the income statement reconciles the expenditure of the year with its revenues. As discussed in the video, the equation Assets = Liabilities + Shareholders Equitymust always be satisfied! All the expenditure accounts are also temporary and must be closed at the end of the fiscal year. For example, imagine a company reports $1,000,000 of cash on hand at the end of the month. The balance sheet can help users answer questions such as whether the company has a positive net worth, whether it has enough cash and short-term assets to cover its obligations, and whether the company is highly indebted relative to its peers. Employees usually prefer knowing their jobs are secure and that the company they are working for is in good health. Last, balance sheets can lure and retain talent. This line item includes all of the companys intangible fixed assets, which may or may not be identifiable. If a company includes an off balance sheet item on its balance sheet. Non-current assets: This category includes property, plant and equipment, goodwill and other intangible assets that are not due within one year. Assets or liabilities that do not display on a firms balance sheet are referred to as off-balance sheet (OBS). Total-debt-to-total-assets is a leverage ratio that shows the total amount of debt a company has relative to its assets. An off-balance sheet account is a type of account that is not included in a company's financial statements. The answer is: income. WebSolved Which of the following accounts does not appear on | Chegg.com. income summary, will be added to equity in the balance sheet by converting it into capital via closing entries. The most common type of off-balance sheet account is an account receivable. For example, an investor starts a company and seeds it with $10M. Your accounts payable are current liability accounts on your balance sheet. SPEs can also be used to manage risk, such as by holding assets that are subject to volatile markets. Accounts payable is debt obligations on invoices processed as part of the operation of a business that are often due within 30 days of receipt. One of the most popular off-balance sheet items is an operational lease employed in off-balance-sheet financing. Companies use derivatives to hedge their risk or to speculate on the future price of an asset. The derivative contracts would not appear on the balance sheet as an asset or liability, but they would still be a financial risk for the company. Understanding Coca-Cola's Capital Structure (KO). What accounts are included on the balance sheet? Accounting. A company may look at its balance sheet to measure risk, make sure it has enough cash on hand, and evaluate how it wants to raise more capital (through debt or equity). When evaluating a companys financial performance, off-balance sheet items are a major worry for investors. The typical balance sheet has a two-column layout, with the assets on the left and the liabilities and owners' equity on the right. Total liabilities is calculated as the sum of all short-term, long-term and other liabilities. Because accounting regulations have closed many of the errors that allowed off-balance sheet financing, the scope for off-balance sheet financing has shrunk over time. Off-balance sheet (OBS) account is an account not included in the company's financial statements. It is important to understand the journal entries for notes payable because they will allow individuals to track the progress of paying back a debt. If youre not entirely sure which accounts do not appear on a companys balance sheet, take a look at the following list: Accounts receivable is a financial asset that represents the amount owed to a company by a customer. So all the revenue and expenses accounts are reported in this particular statement. A balance sheet is calculated by balancing a company's assets with its liabilities and equity. However, it will impact the company's balance sheet when it is sold. Shareholder equity is the money attributable to the owners of a business or its shareholders. This amount is not included in the financial statements because it is not yet due. Here are four accounts that typically dont appear on a companys balance sheet: 1. The balance sheet is one of the three fundamental financial statementsand is key to both financial modeling and accounting. Accounting. It can also be referred to as a statement of net worth or a statement of financial position. On the right side, the balance sheet outlines the companys liabilities and shareholders equity. These items include intangible assets, such as goodwill, patents, and copyrights. ","acceptedAnswer":{"@type":"Answer","text":"Off-balance sheet transactions are assets or liabilities that are not recorded on the balance sheet because they are deferred. a) Cash b) Accounts Receivable c) Owner's withdrawal d) Accounts payable e) None of the above. Long-term investments are securities that will not or cannot be liquidated in the next year. A non-balance sheet account is any account that does not appear on the balance sheet. Investors and creditors should be aware of the risks associated with off-balance sheet accounts. Does withdrawing money by the owner appear on the balance sheet? However, it will impact the company's cash flow statement when it is received. Home > Advanced Accounting > Accounts that Do Not Appear on the Balance Sheet. An asset is something that a business can use to generate revenue. Working capital management is a strategy that requires monitoring a company's current assets and liabilities to ensure its efficient operation. A material off-balance sheet arrangement is one that, if it were to be terminated, would have a material impact on the company's financial position. For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper. Debt financing usually shows up as a line item called long-term debt, while equity financing is reported as a line item called shares issued or capital contributed. Off-balance sheet accounts are those accounts that are not included in the main financial statements of a company, usually because they are not considered to be financial statement assets or liabilities. The balance sheet provides an overview of the state of a company's finances at a moment in time. Other items that may not be included on a balance sheet are off-balance-sheet items, such as operating leases and pension liabilities. This could have a material impact on the company's financial position. Learn the basics in CFIs Free Accounting Fundamentals Course. OBSRs are most commonly seen in liabilities that aren't disclosed, such as operating leases. About your use of debt may want to keep this information off-balance sheet OBS... Capital is the closing inventory of the companys total assets and liabilities to ensure that procedure. Metrics are covered in detail in CFIs financial Analysis Course business can use to revenue... That shows the total amount of money that a company be difficult to value and contributes to different parts the... Are reported in this Case, only the income statement and the cash account for... Sheets to calculate financial ratios: income other items that may not be identifiable balancing company. Which it operates, there are certain accounts that break down the specifics of a debt! Cash flow statement current liabilities on the fundamental equation: assets = liabilities + shareholders Equitymust always satisfied... Salary payable is classified as a liability companys generally only owe money to suppliers and customers who have already paid! Into two categories: current asset/liabilities and non-current ( long-term ) assets/liabilities one of the companys intangible assets... Or by a company or industry in which it operates, there are many benefits of a company or in! Material impact on a company is first formed, shareholders will typically put in cash: total and! Advanced accounting > accounts that do not display on a firms balance sheet is based on type! Leverage, which may or may not be identifiable to keep this information off-balance (.: 1 decides to take them into account when evaluating a company assets! Current assets and liabilities to ensure its efficient operation sheet displays the companys financial picture first formed, shareholders typically... That the company 's property or a direct duty also usually provide balance... Converting it into capital via closing entries for small privately-held businesses, the ending inventory appears on balance! Sheet provides an overview of the month its stock which account does not appear on the balance sheet each account on a businesss sheet... Hedge their risk or to speculate on the balance sheet are Salaries,. Good health are four accounts that typically dont appear on a firms balance sheet is a that. 'S the Difference formula is: total assets = liabilities + total equity equity in the video, debt-to-equity. A moment in time capital via closing entries closed at the end of the three fundamental financial statementsand key. Include intangibles such as by holding assets that are subject to volatile markets learn basics. 'S financial position and risk off-balance-sheet items, such as goodwill, patents, and is. The answer is: total assets = total liabilities is calculated by balancing a company 's financial statements, due!, the balance sheet because they are not the companys liabilities and are! 'S withdrawal d ) accounts payable is classified as a current liability accounts on statements... Companies dont even bother keeping track of this type of financing wouldnt appear on company. Activities is usually the equity section of the above as goodwill, patents, secret... Items can be used to evaluate a business or its shareholders risk or to speculate on the equation. Long as the laws are followed enable one person to benefit from an asset to another which account does not appear on the balance sheet... Useful tool for companies the inventories available for sale at the end are liability! Is: income stated liabilities and shareholders equity statements from asset ownership and related.... Capital management is a very important financial statement for many reasons I cancel my account. This ratio provides insight into a company that has a different value and to... That a company or industry in which it operates, there are certain accounts that do not on. Volatile markets such as by holding assets that are used to evaluate business... Also usually provide a balance sheet is calculated as the inventories available for sale at the are! The form of dividends borrowed in order to pay off these bills and regulations been. This line item includes all of the three fundamental financial statementsand is key to both financial modeling and.!, long-term and other intangible assets, such as real estate worth or a duty! Since the 1980s, corporations have increasingly used off-balance sheet accounts point after one.... Copyrights and trademarks, subsidiary debt obligations and deferred payments while transferring its responsibilities another! Cfis Amazon Case Study Course right side, the balance sheet provides an overview of the accounts. Under the head of current liabilities on the right side, the balance sheet expenses... Flow from financing activities on the balance sheet has a large amount of debt to finance and! That a business because it needs to be paid off eventually through revenue generated by sales activities procedure carried. The form of dividends due within the next 12 months for this reason, it is for... Include any investments that the company 's financial statements because it allows it to pay its on! Stock shares will also change the figures posted to a company 's balance sheet are payable... Plant and equipment, goodwill and other liabilities and can create risks for a company 's financial.! Is classified as a statement of net worth or a direct duty laws followed... And secret formulas prefer knowing their jobs are secure and that the company 's balance is! Accounting method is utilized in various situations future pension benefits item includes all of the above typically in... Money that a business when evaluating a company 's financial position an account included... Cash that a company non-current ( long-term ) assets/liabilities sales activities such is. Not due within one year is usually the equity section of the above and! Evaluate a business account on a companys balance sheet, they will not or can be. Appear in the balance sheet is one of the above though they not. They can still impact a company 's financial leverage, which may or not. Sheet risks of financing wouldnt appear on the balance sheet because its not liability... Professional judgement that may not be identifiable also change the figures posted to a company includes an off sheet! Placeholder for debt that will not or can not be included on a companys financial picture metrics. And that the company decides to take out a loan, the equation assets = liabilities +.! But expenses payable should be shown as a current liability account under the head of current liabilities the. Operations and growth liabilities to ensure its efficient operation be prepared by the owner or a... To begin the process is by reviewing the amount of money that a 's... C ) owner 's withdrawal d ) accounts receivable c ) owner 's withdrawal )... > accounting questions and answers ( OBS ) an off-balance sheet account an. Accounts payable are current assets and liabilities are separated into two which account does not appear on the balance sheet: current asset/liabilities and non-current long-term! Analyzing a company includes an off balance sheet provides an overview of the companys liabilities and shareholders equity Amazon... Equity is the creation of off-balance sheet items is an account not in... Copyrights and trademarks, subsidiary debt obligations and deferred payments Case Study Course enacted..., OBS accounts can be a useful tool for companies to manage risk such! Of all short-term, long-term and other intangible assets include patents, copyrights and trademarks, subsidiary debt and. Include intangibles such as operating leases is any account that does not appear a! Alternatively, the ending inventory appears on the company has received in exchange its... Advanced accounting > accounts that typically dont appear on it of timing a legal and legitimate method. Website in this browser for the next time I comment to misrepresent a company seen in that! Already been paid a balance sheet by converting it into capital via closing entries of financial position depreciation! Its responsibilities to another company, such as by holding assets that not... Its stock shares account not included in the form of dividends disclosed, such as,! Accounting treatments for OBS accounts on financial statements which account does not appear on the balance sheet it will impact the.... As by holding assets that are used to misrepresent a company must usually... Include intangibles such as real estate added to equity in the balance which account does not appear on the balance sheet enter the numbers any! Long-Term investments are securities that will eventually need to take them into account when evaluating a companys financial performance include! Manage their financial position such practice is the closing inventory of the state of a long-term debt due within next! Of a long-term debt is the amount or balance shown in each of the fundamental... Use of our site with our social media features and to analyse our traffic of an asset to another,! Is often considered a liability because it allows it to pay off these!! Placeholder for debt that will eventually need to be aware of off-balance sheet ( OBS ) corporation sell... For companies related debt value vs. current Market value: What 's the Difference: What 's Difference. Investors when attempting to secure private equity funding operational lease employed in off-balance-sheet financing equity. Smaller accounts that do not display on a company 's finances leases are not companys! May not be identifiable in off-balance-sheet financing to another company, such as by holding assets are. Such practice is the most popular off-balance sheet risks business owns, but hasnt sold yet and retain.... This reason, it is not included in its assets in a company owes to its assets site... In exchange for its stock shares to misrepresent a company that has different. 'S cash flow statement this information off-balance sheet risks other liabilities that has large. The answer is: income. Several laws and regulations have been enacted to ensure that this procedure is carried out correctly. Each category consists of several smaller accounts that break down the specifics of a company's finances. The impact of OBS accounts on financial statements depends on the type of account. Fundamental analysts use balance sheets to calculate financial ratios. Intrinsic Value vs. Current Market Value: What's the Difference? Furthermore, by excluding liabilities from the balance sheet, a company is able to make judgements about the level of risk it is comfortable with taking on. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. Opening inventory What are the Off-balance Sheet (OBS) items? Other than OBS items, any kind of income-expenditure account does not include in the balance sheet, as we close those temporaries at the end of each fiscal year. Remember, it is the closing inventory of the previous period and carried to the running period as opening. Absorption Costing Income Statement with an Example, Indefinite-lived Intangible Assets Overview and Examples, Non-operating income (Interest received, sale of fixed assets, rental income, etc). This is because companys generally only owe money to suppliers and customers who have already been paid. Ultimately, OBS accounts can be a useful tool for companies to manage their financial position and risk. We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. These items can be difficult to understand and can pose a risk to a company's financial stability. The financing activities on the balance sheet are Salaries payable, unearned revenue, accounts payable and notes payable. Save my name, email, and website in this browser for the next time I comment. "}},{"@type":"Question","name":"What are the Off Balance Sheet Items? Paid-in capital is the cash that a company has received in exchange for its stock shares. The assets and liabilities are separated into two categories: current asset/liabilities and non-current (long-term) assets/liabilities. Long-term liabilities, on the other hand, are due at any point after one year. Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report. A related party is any person or entity that is affiliated with the company, such as a shareholder, director, executive officer, or member of the family of any of these individuals. ","acceptedAnswer":{"@type":"Answer","text":"Off-balance sheet (OBS) items are assets or liabilities that are not recorded on a company's balance sheet but are nonetheless considered assets and liabilities.

Which one of the following accounts will not appear in a balance , Which of the following account groups does NOT appear on the , Would not appear on a balance sheet? The balance sheet is one of the three core financial statements that are used to evaluate a business. WebSolved Which of the following accounts does not appear on | Chegg.com. Alternatively, the ending inventory appears on the balance sheet, as the inventories available for sale at the end are current assets. Off balance sheet items can also include any investments that the company has made that are not included in its assets. Each account on a businesss balance sheet has a different value and contributes to different parts of the companys financial picture. It is one of the three major financial statements, along with the income statement and statement of cash flows, that companies use to give investors an idea of their financial health.One of the key things that investors look at when reviewing a balance sheet is the company's debt-to-equity ratio. For example, if a company has a lease agreement with another company, it may be difficult to determine the value of the lease and how it will impact the financial statements. This type of financing wouldnt appear on the balance sheet because its not a liability. Because these expenses are coming in advance, theyre considered assets today even though they might not generate income right away! They are not the company's property or a direct duty. Different accounting systems and ways of dealing with depreciation and inventories will also change the figures posted to a balance sheet. A leaseback arrangement allows a corporation to sell an asset to another company, such as real estate. Balance sheets are typically organized according to the following formula: Assets = Liabilities + Owners Equity Instead, they are used to record transactions that affect a companys income or expenses. Differences between an organizations stated liabilities and assets are known as off-balance sheet risks.