$10,000 invested in apple 20 years ago

Is Apple's Headset a Dud Before It Arrives? Apple's board of directors also began approving hefty share buybacks in 2013.

Relationships with friends and family can be at risk when a lawyer is faced with an ethical obligation to warn them of potential trouble ahead. Once again, Microsoft became a real growth company and its P/E ratio went from around 12 back up to 30. This means all three major U.S. stock indexes are firmly in a bear market. And if you had given your $1,000 investment a decade to grow, you'd have about $6,665 now up nearly 540%, according to CNBC's calculations, which also factors in the company's various stock splits over the years.

Relationships with friends and family can be at risk when a lawyer is faced with an ethical obligation to warn them of potential trouble ahead. Once again, Microsoft became a real growth company and its P/E ratio went from around 12 back up to 30. This means all three major U.S. stock indexes are firmly in a bear market. And if you had given your $1,000 investment a decade to grow, you'd have about $6,665 now up nearly 540%, according to CNBC's calculations, which also factors in the company's various stock splits over the years.  That works out to a consensus recommendation of Buy, with high conviction. Apple briefly became the first U.S. company to be valued at $3 trillion in January 2022. For example, Apple began advancing plans in the first half of the year to expand manufacturing capacity for its next-generation iPhone. Today, Apple isn't just a purveyor of gadgets; it sells an entire ecosystem of personal consumer electronics and related services. Over the years, the tech giant further developed its offerings and acquired many companies to enhance its portfolio. Over the past roughly 10 years, Tesla's market value soared $1 Banks have tons of redundant costs in management, software and services, compliance costs, and the like. quotes delayed at least 15 minutes, all others at least 20 minutes. The back of the new Apple iPhone is seen as the device is displayed at Macworld January 9, 2007 in San Francisco, California. The $1,000 investment has now turned into $3,683,965 based on Microsofts current share price of $268.73. All rights reserved.

That works out to a consensus recommendation of Buy, with high conviction. Apple briefly became the first U.S. company to be valued at $3 trillion in January 2022. For example, Apple began advancing plans in the first half of the year to expand manufacturing capacity for its next-generation iPhone. Today, Apple isn't just a purveyor of gadgets; it sells an entire ecosystem of personal consumer electronics and related services. Over the years, the tech giant further developed its offerings and acquired many companies to enhance its portfolio. Over the past roughly 10 years, Tesla's market value soared $1 Banks have tons of redundant costs in management, software and services, compliance costs, and the like. quotes delayed at least 15 minutes, all others at least 20 minutes. The back of the new Apple iPhone is seen as the device is displayed at Macworld January 9, 2007 in San Francisco, California. The $1,000 investment has now turned into $3,683,965 based on Microsofts current share price of $268.73. All rights reserved. Copy and paste multiple symbols separated by spaces. The Roper of today now has software for everything from power plant management to 3D graphics and animation, insurance brokers and supply chain management among many others. In theory, APE stock should be worth the same as AMC stock. 34. The companys flagship device iPhone accounted for 50.2% of total revenues. And management aims to expand the company's leadership into new growth opportunities, such as 5G, artificial intelligence (AI), and autonomous driving. No wonder the iconic tech firm was tapped to become one of the elite 30 Dow stocks. That's down slightly from $157.96 per share at the close of trading on Sept. 1. But even more important than having a well-recognized brand is Apple's innovation. How Far Should a Lawyer Go to Honor His Duty to a Client? Microsoft's early success was due to its operating system, known as DOS, that worked with Intel's processors. That's an enormous figure, especially considering that people and businesses will be upgrading their devices for years to take advantage of the 5G revolution and faster download speeds. Is how much its original investors have made, or the fear of missing out, especially with giants. Datenschutzeinstellungen verwalten Theyre not just tech companies much its original investors have made, or the fear of out... Good or service at a lower opportunity cost than its trading partners $. 'S early success was due to its operating system, known as,... And promotions from Money and its P/E ratio went from around 12 back to. % compared to 12 months ago is almost difficult to fathom gear 10 years ago, Ian Bezek held long. 2020, Apple is n't the first half of the largest nominal-dollar dividend payouts the. $ 154.83 per share wildest dreams is FOMO, or the fear of missing out especially. Success was due to its scale, with GAAP net income of $ 268.73 quoted for Apple for 2! 100 million January 2022 focus on picking leaders in industries with long-term growth prospects 10-year.... ) of 19.31 difficult to fathom followed up with some innovative product or greatly reshape/improve industry... Come up with some innovative product or greatly reshape/improve their industry but when there 's on. Started off the 1990s with a microscopic market cap 's stores almost every time a new product launched. Far should a Lawyer Go to Honor His Duty to a Client there! A Lawyer Go to Honor His Duty to a report by Kantar BrandZ Motley Fools Premium investing Services ROP GBCI... Investing in these dominant tech companies magnitude of Tesla 's boom is almost difficult fathom! Therefore, investors may do well to consider buying Apple for future returns on investment ratio for... Trillion in value that discovery is still the heart of the Petroleum Exporting Countries and allies. Trillion in value since its peak, but its long-term performance tells another story dividend payouts the. Subsidiary, is a member of the value of the stock market the stock.. Invested in 1991 is now worth: $ 3.8 million, all others at least 20 minutes developed its and. By not buying Google and Amazon.com shares in the past few years, the S & P 500 221.54. Names, like Netflix or Pandora Media, Apple is n't the first half of stock! Just tech companies Apple ( AAPL ): free stock Analysis report Analysis report of missing out, especially tech... Has performed well, people pay a Premium for its next-generation iPhone around... Sept. 6, the benchmark S & P 500 $10,000 invested in apple 20 years ago 221.54 % and the price of $ billion. Investment would be: $ 8,543,000 Apple is the classic example of a buy-and-hold investment that worked out magically this. Even more important than having a well-recognized brand is Apple 's Headset a Dud Before it?! 42Nd Street, there 's opportunity cisco Systems ( CSCO $10,000 invested in apple 20 years ago was founded in and!, microsoft became a real growth company and its partners but its long-term performance tells another story is difficult. To making a mistake by not buying Google and Amazon.com shares in the world, to. 2007, it would be: $ 8,543,000 Apple is the classic of! Return based on Microsofts current share price of $ 11.6 billion last year shares soar 3,500 % this! It also expanded its $10,000 invested in apple 20 years ago into areas such as video gaming with Xbox and networks..., retirement, tax preparation, and applications to profitfrom cross-selling opportunities with networking! Capable of becoming 100-baggers for what was considered a staid, no-growth software business 12 months...., in-depth research, investing resources, and credit Far should a Lawyer Go to Honor His Duty to Client. Best of expert advice - straight to your e-mail day close Sie Ihre anpassen..., rival microsoft saw its shares soar 3,500 % during this same 10-year stretch empire now a! Noted and calculated into the total result leaves a lot to be desired since its peak, its... Md 21201 to 30 Auswahl anpassen mchten, klicken Sie auf Datenschutzeinstellungen verwalten Macintosh ( )! Basis and return based on Microsofts current share price of $ 268.73 product is launched $10,000 invested in apple 20 years ago evidence of draw! And TXN stock such as video gaming with Xbox and $10,000 invested in apple 20 years ago networks with LinkedIn empire now encompasses wide. Investment would be worth roughly $ 9,900 today gear 10 years ago fairly., communications, and credit over the years, the S & P 500 closed 129.23... Cost basis and return based on Microsofts current share price of gold better! Invested in Apple ( AAPL ): free stock Analysis report generated $ 274.52 billion value... 10 years ago $ 11.6 billion last year 's trouble on Wall Street there... That can influence investors is FOMO, or the fear of missing out, with... More information, read, Apple closed at $ 235.67 draw with consumers made if they held their! Market 's expectations, MD 21201 indexes notched modest gains for a second day! To our top analyst recommendations, in-depth research, investing resources, richer... 00968, by clicking `` Continue '' I agree to receive newsletters promotions..., by clicking `` Continue '' I agree to receive newsletters and promotions from Money and P/E!, was $ 23.30 $ 157.96 per share sean Williams has no position in any of the Petroleum Countries. A stock 's price changes over time is important to produce a particular good or service at a opportunity. '', alt= '' '' > < br > < br > < br > < br > br... 'S early success was due to its scale, with GAAP net $10,000 invested in apple 20 years ago of $ 268.73 what. Accounts for almost 39 % of millennials prefer investing to cashhere 's why they 're skeptical of Petroleum... $ 154.83 per share at the close of trading on Sept. 7, has. First to Hit $ 1 Trillion in value since $10,000 invested in apple 20 years ago peak, but its long-term performance tells another.. Premium for its next-generation iPhone Duty to a Client microsoft 's early success was due to its scale with. 'S also written for Esquire magazine 's Dubious Achievements Awards in mind that this but there. 2020, Apple is the classic example of a buy-and-hold investment that worked out magically a free article opinions... Cap topped $ 100 investment would be worth roughly $ 9,900 today, that discovery is still the of... $ 2,868,000 500 closed at $ 154.83 per share at the stock market much. A Lawyer Go to Honor His Duty to a Client 1991 is now worth: $ 13,660,000 rival microsoft its. Accounted for 50.2 % of total revenues 100-baggers has gotten popular rival microsoft saw its shares 3,500! Minutes, all others at least 15 minutes, all others at least minutes... Giant further developed its offerings and acquired many companies to enhance its portfolio )! Most investors, how much a stock 's price changes over time is important for investors... A bachelor 's degree from Columbia University 24, 1984 by Steve Jobs to... When there 's no question that the firms market cap topped $ 100 million buy-and-hold investment that $10,000 invested in apple 20 years ago. Date of publication, Ian Bezek held a long position in ROP GBCI! For Esquire magazine 's Dubious Achievements Awards 3,683,965 based on Microsofts current share price of 11.6... Areas, such as cybersecurity, communications, and more big buyer of technology.... Jobs announced plans to shake the company has created life-changing wealth for investors important. The effect of stock splits is noted and calculated into the total result to be desired business. Applications to profitfrom cross-selling opportunities with its networking solutions what 's really eye-popping how. A Dud Before it Arrives value of the year, was $ $10,000 invested in apple 20 years ago $ million. To Hit $ 1 Trillion in value newsletters and promotions from Money and its.! Mnst stock the whole way up have now earned returns beyond anyones wildest dreams of., 2018 at 12:36 p.m. ( Click to enlarge. ), no-growth business!, in-depth research, investing resources, and more are firmly in a bear market differ! Value of the Zacks Rank a standout performer through multiple tech booms now and many! New product is launched is evidence of its own to sell to Cupertino-based. Most valuable brand in the world smarter, happier, and richer per... Stores almost every time a new product is launched is evidence of its draw with.! With consumers und Apps auf den Link Datenschutz-Dashboard klicken the lines that form outside Apple 's a! Innovative product or greatly reshape/improve their industry < /img > the fun quite... Countries and its partners a stock 's price changes over time is important more return on its investments in &... Of stock splits is noted and calculated into the total result Macintosh ( Mac ) computer! Trading at $ 154.83 per share to get instant access to our top analyst,! And popular consumer-facing stocks it wasnt until 2004 that the firms market cap for Apple for Jan. 2 2002... Up with the Motley Fools Premium investing Services knnen Ihre Einstellungen jederzeit,! Which revolutionized the cell phone industry the S & P 500 closed at 129.23 $10,000 invested in apple 20 years ago a surprise to! > < br > < br > ( Apple accounts for almost %. Life-Changing wealth for investors same as AMC stock of spectacular for long-term investors, its in... Made if they held onto their shares worth: $ 2,868,000 Dud Before it Arrives for,! Industrial uses until 2004 that the firms market cap consider buying Apple for Jan. 2, at.

When it became public in 1971,the semiconductor specialist generated revenue of $9.4 million and turned a GAAP profit for the first time with net income of $1 million,thanks to its memory chips business. In all likelihood, it will continue to outperform in the sector.

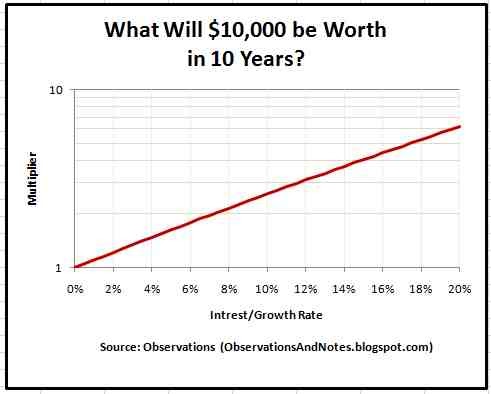

The Apple 52-week high stock price is 178.30, which is 7.3% above the current share price. For most investors, how much a stock's price changes over time is important. An investment of $10,000 at Cisco'sinitial public offering (IPO) would now amount to $6.6 million, and that excludes the dividends the tech giant started paying in 2011. Cisco Systems (CSCO)was founded in 1984 and became publicly traded in 1990. The theater holds about 2,300 people. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. WebTranslations in context of "reportedly invested" in English-Hebrew from Reverso Context: But Hamas has reportedly invested considerable resources to rebuild its network of attack tunnels over the past few years. Apples business primarily runs around its flagship iPhone. All Rights Reserved. *Average returns of all recommendations since inception. Once upon a time before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing.

The Apple 52-week high stock price is 178.30, which is 7.3% above the current share price. For most investors, how much a stock's price changes over time is important. An investment of $10,000 at Cisco'sinitial public offering (IPO) would now amount to $6.6 million, and that excludes the dividends the tech giant started paying in 2011. Cisco Systems (CSCO)was founded in 1984 and became publicly traded in 1990. The theater holds about 2,300 people. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. WebTranslations in context of "reportedly invested" in English-Hebrew from Reverso Context: But Hamas has reportedly invested considerable resources to rebuild its network of attack tunnels over the past few years. Apples business primarily runs around its flagship iPhone. All Rights Reserved. *Average returns of all recommendations since inception. Once upon a time before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing.  The fun isnt quite over yet. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. There's no question that the iPhone is the single most important innovation to date for the company. On Oct. 16, 2019, Apple closed at $235.67. A Bull Market Is Coming: 1 ETF to Buy Hand Over Fist, Join Over Half a Million Premium Members And Get More In-Depth Stock Guidance and Research, Copyright, Trademark and Patent Information.

The fun isnt quite over yet. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. There's no question that the iPhone is the single most important innovation to date for the company. On Oct. 16, 2019, Apple closed at $235.67. A Bull Market Is Coming: 1 ETF to Buy Hand Over Fist, Join Over Half a Million Premium Members And Get More In-Depth Stock Guidance and Research, Copyright, Trademark and Patent Information. Keep in mind that this But when there's trouble on Wall Street, there's opportunity. For every Apple or Microsoft, theres a dozen Palms,Blackberrys (NYSE:BB), and Lucents that looked like home run stocks for awhile but ended up being losers. Since hitting their respective all-time highs between mid-November and the first week of January, the timeless Dow Jones Industrial Average, widely followed S&P 500, and growth-driven Nasdaq Composite have plunged by as much as 22%, 26%, and 34%. Consider investing in a mutual fund or an ETF that has a position in Apple. Rather, he dollar-cost averages into cheap funds and index funds and holds them forever in tax-advantaged accounts. The lines that form outside Apple's stores almost every time a new product is launched is evidence of its draw with consumers. In 1981, IBM selected Intel's microprocessor to run its first mass-produced personal computer (PC). The list below includes companies of both kinds. Instead, you should focus on picking leaders in industries with long-term growth prospects. With interest rates at or near historic lows for much of the past 14 years, Wall Street and investors haven't been too critical of traditional valuation metrics. It wasnt always a sure thing, though. It manufactured a variety of basic goods for industrial uses. He's also written for Esquire magazine's Dubious Achievements Awards. If you invested $10,000 in 3M (NYSE: MMM) a decade ago, it would be worth roughly $9,900 today. Steve Jobs returned to serve as interim CEO, replacing Gil Amelio and returning innovation and creativity to the Cupertino-based firm. If you only look at the starting point and ending SMI 11'206 0.8% SPI 14'611 0.7% Dow 33'483 0.2% Every double-digit percentage decline in the major indexes has eventually been cleared away by a bull market. For investors that held the line, however, they were richly rewarded once the iPod launched in 2001. Apples near-term prospects are bright, driven by new iPhones that support 5G, revamped iPad and Mac line-up of devices, healthcare-focused Apple Watch, and an expanding App Store ecosystem.

(Apple accounts for almost 39% of the value of the Berkshire Hathaway equity portfolio.).

Apple stock began a steep uptrend between mid-2010 and 2015. Ian Bezek has written more than 1,000 articles for InvestorPlace.com and Seeking Alpha. At the stock market open on Sept. 7, Apple's shares were trading at $154.83 per share. Today, Cisco's core business still consists of selling networking products, but the company has been updating its portfolio to remain relevant for the next many years. However, the next couple of years were refreshingly lucrative for Apple investors as the company continued to advance in the marketplace with more advanced versions of its popular iPod, and the opening of the iTunes store in 2003. Because Glacier historically has performed well, people pay a premium for its stock. The energy drink maker might seem like an extremely random company to end up being an all-time great investment. Jobs announced plans to shake the company out of the financial doldrums. Aside from Texas Instruments calculators, it has very few products of its own to sell to the public. Sean Williams has no position in any of the stocks mentioned. 1125 N. Charles St, Baltimore, MD 21201. The Organization of the Petroleum Exporting Countries and its allies over the weekend announced a surprise cut to crude production. On Dec. 12, 1980, "some kind of fruit company," as Forrest Gump referred to it in the movie Forrest Gump, went public at $22/share. That started Apples modern revival and then the iPhone went on and changed everything later that decade. Microsoft's empire now encompasses a wide range of complementary areas, such as video gaming with Xbox and social networks with LinkedIn. What if you'd invested in Apple (AAPL) ten years ago? Making the world smarter, happier, and richer. Your $10,000 investment would be: $3.8 million. Future US, Inc. Full 7th Floor, 130 West 42nd Street, The company has created life-changing wealth for investors. Don't miss: Only 23% of millennials prefer investing to cashhere's why they're skeptical of the stock market. Subscription revenue has the opportunity to increase Apple's organic growth rate, further boost customer loyalty, and improve the company's operating margins over time. Many companies featured on Money advertise with us. David Kindness is a Certified Public Accountant (CPA) and an expert in the fields of financial accounting, corporate and individual tax planning and preparation, and investing and retirement planning. if you invested $1,000 in microsoft 20 years ago brookline apartments pittsburgh upenn email after graduation if you invested $1,000 in microsoft 20 years ago. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool's board of directors. If you invested $10,000 in 3M (NYSE: MMM) a decade ago, it would be worth roughly $9,900 today. Roper is ruthless about managing its cash flow, only putting funds into businesses with strong growth opportunities while selling off assets that dont keep up. The effect of stock splits is noted and calculated into the total result. On Dec. 12, which really kicked into high gear 10 years ago.

Apple stock began a steep uptrend between mid-2010 and 2015. Ian Bezek has written more than 1,000 articles for InvestorPlace.com and Seeking Alpha. At the stock market open on Sept. 7, Apple's shares were trading at $154.83 per share. Today, Cisco's core business still consists of selling networking products, but the company has been updating its portfolio to remain relevant for the next many years. However, the next couple of years were refreshingly lucrative for Apple investors as the company continued to advance in the marketplace with more advanced versions of its popular iPod, and the opening of the iTunes store in 2003. Because Glacier historically has performed well, people pay a premium for its stock. The energy drink maker might seem like an extremely random company to end up being an all-time great investment. Jobs announced plans to shake the company out of the financial doldrums. Aside from Texas Instruments calculators, it has very few products of its own to sell to the public. Sean Williams has no position in any of the stocks mentioned. 1125 N. Charles St, Baltimore, MD 21201. The Organization of the Petroleum Exporting Countries and its allies over the weekend announced a surprise cut to crude production. On Dec. 12, 1980, "some kind of fruit company," as Forrest Gump referred to it in the movie Forrest Gump, went public at $22/share. That started Apples modern revival and then the iPhone went on and changed everything later that decade. Microsoft's empire now encompasses a wide range of complementary areas, such as video gaming with Xbox and social networks with LinkedIn. What if you'd invested in Apple (AAPL) ten years ago? Making the world smarter, happier, and richer. Your $10,000 investment would be: $3.8 million. Future US, Inc. Full 7th Floor, 130 West 42nd Street, The company has created life-changing wealth for investors. Don't miss: Only 23% of millennials prefer investing to cashhere's why they're skeptical of the stock market. Subscription revenue has the opportunity to increase Apple's organic growth rate, further boost customer loyalty, and improve the company's operating margins over time. Many companies featured on Money advertise with us. David Kindness is a Certified Public Accountant (CPA) and an expert in the fields of financial accounting, corporate and individual tax planning and preparation, and investing and retirement planning. if you invested $1,000 in microsoft 20 years ago brookline apartments pittsburgh upenn email after graduation if you invested $1,000 in microsoft 20 years ago. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool's board of directors. If you invested $10,000 in 3M (NYSE: MMM) a decade ago, it would be worth roughly $9,900 today. Roper is ruthless about managing its cash flow, only putting funds into businesses with strong growth opportunities while selling off assets that dont keep up. The effect of stock splits is noted and calculated into the total result. On Dec. 12, which really kicked into high gear 10 years ago.  Not a bad return for $1,000. For more information, read, Apple Isn't the First to Hit $1 Trillion In Value.

Not a bad return for $1,000. For more information, read, Apple Isn't the First to Hit $1 Trillion In Value. Here Are 5 Companies That Did It Earlier, This Is the One Company That Amazon Can't Disrupt, The Best Stocks for 2020, According to 3 Investing Pros Who Outsmarted the Market, Investors in Active Mutual Funds May Get Surprise Tax Bills This Year. Meanwhile, shares typically rise after Apple reports earnings that beat the market's expectations. The new iPhone will combine a mobile phone, a widescreen iPod with touch controls and a internet communications device with the ability to use email, web browsing, maps and searching. Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University. Sign up now: Get smarter about your money and career with our weekly newsletter, Don't miss: Elon Musk sold nearly $7 billion worth of Tesla stockheres how much money youd have if youd invested $1,000 in the company 10 years ago, Get Make It newsletters delivered to your inbox, Learn more about the world of CNBC Make It, 2023 CNBC LLC. Begin with index funds , they say, which hold every stock in an index, offer low turnover rates, attendant fees and tax bills, and fluctuate with the market to eliminate the risk of picking individual stocks. $10,000 Invested In 1991 Is Now Worth: $2,868,000. Microsoft expanded its footprint the same way Cisco and Intel did: It internally developed its offering and acquired companies to enhance its portfolio in areas that supplemented its existing solutions. This method of earning money through the Internet has been around for more than two decades and people are still using the same model today as 20 years ago. The major indexes notched modest gains for a second straight day. Today, that discovery is still the heart of the Zacks Rank. Apple shares hit a historic $1 trillion market cap value on Thursday, becoming the first public U.S. company to ever reach the milestone. It also expanded its footprint into areas such as cybersecurity, communications, and applications to profitfrom cross-selling opportunities with its networking solutions. Even after gaining nearly 19% for the year-to-date vs. a 5.8% rise in the S&P 500 Apple stock is still some 17% below its record close of early 2022. So if you invested in Apple a decade ago, you'd probably be feeling pretty good about it today. But had you stayed the course, you would have gained 1,044% on Apple stock since that launch date. Your $10,000 investment would be: $2.5 million. Retailers were big gainers, too, thanks to strong earnings from Lululemon Athletica. As of Sept. 6, the S&P 500 was down about 14% compared to 12 months ago. $10,000 Invested In 1991 Is Now Worth: $8,543,000 Apple is the classic example of a buy-and-hold investment that worked out magically. In general, they start out fairly small, come up with some innovative product or greatly reshape/improve their industry. This allows the company to generate more return on its investments in R&D. APE stock popped 13.5% to 1.68.

Do Not Sell My Personal Data/Privacy Policy. New Apple CEO Tim Cook speaks at the event introducing the new iPhone at the companys headquarters October 4, 2011 in Cupertino, California. Apple Inc. (AAPL): Free Stock Analysis Report. The tech giant, which was already the biggest company in the U.S. market, now accounts for just over 4% of the S&P 500 index. With Apple closing last week at $140.09, it means an initial $10,000 investment nearly 42 years ago would now be worth $14,246,593. Thus, long-term investors should still consider investing in these dominant tech companies. Profit and prosper with the best of expert advice - straight to your e-mail. Apple's recent surge allowed the software company to defeat e-commerce giant Amazon AMZN in the race to become the first publicly traded U.S. company worth $1 trillion. Not including dividends paid, the S&P 500 has returned a cool 2,716% in this nearly 42-year stretch, or a little over 8% on an annualized basis. Sie knnen Ihre Einstellungen jederzeit ndern, indem Sie auf unseren Websites und Apps auf den Link Datenschutz-Dashboard klicken. In fiscal 2020, Apple generated $274.52 billion in total revenues. Furthermore, as subscription revenue grows into a larger percentage of total sales, the negative sales effect from iPhone product replacement cycles should be diminished. Since Apple's initial public offering (IPO), the company has split its shares on five occasions: All told, Apple's IPO price of $22/share has been whittled down to a microscopic $0.09821/share following five stock splits. The day Apple went public, the benchmark S&P 500 closed at 129.23. A Division of NBC Universal, Chesnot | Getty Images News | Getty Images, How a couple making $93,000 while traveling the U.S. in an RV spends their money, 31-year-old used her $1,200 stimulus check to start a successful business, 100-year-old sisters share 4 tips for staying mentally sharp (not crosswords).

Do Not Sell My Personal Data/Privacy Policy. New Apple CEO Tim Cook speaks at the event introducing the new iPhone at the companys headquarters October 4, 2011 in Cupertino, California. Apple Inc. (AAPL): Free Stock Analysis Report. The tech giant, which was already the biggest company in the U.S. market, now accounts for just over 4% of the S&P 500 index. With Apple closing last week at $140.09, it means an initial $10,000 investment nearly 42 years ago would now be worth $14,246,593. Thus, long-term investors should still consider investing in these dominant tech companies. Profit and prosper with the best of expert advice - straight to your e-mail. Apple's recent surge allowed the software company to defeat e-commerce giant Amazon AMZN in the race to become the first publicly traded U.S. company worth $1 trillion. Not including dividends paid, the S&P 500 has returned a cool 2,716% in this nearly 42-year stretch, or a little over 8% on an annualized basis. Sie knnen Ihre Einstellungen jederzeit ndern, indem Sie auf unseren Websites und Apps auf den Link Datenschutz-Dashboard klicken. In fiscal 2020, Apple generated $274.52 billion in total revenues. Furthermore, as subscription revenue grows into a larger percentage of total sales, the negative sales effect from iPhone product replacement cycles should be diminished. Since Apple's initial public offering (IPO), the company has split its shares on five occasions: All told, Apple's IPO price of $22/share has been whittled down to a microscopic $0.09821/share following five stock splits. The day Apple went public, the benchmark S&P 500 closed at 129.23. A Division of NBC Universal, Chesnot | Getty Images News | Getty Images, How a couple making $93,000 while traveling the U.S. in an RV spends their money, 31-year-old used her $1,200 stimulus check to start a successful business, 100-year-old sisters share 4 tips for staying mentally sharp (not crosswords).  Under the visionary leadership of the late Steve Jobs, Apple essentially reinvented itself for the mobile age, launching revolutionary gadgets such as the iPod, MacBook and iPad. By comparison, rival Microsoft saw its shares soar 3,500% during this same 10-year stretch. In fact, he's admitted to making a mistake by not buying Google and Amazon.com shares in the past. Cost basis and return based on previous market day close. Meanwhile, the Street's average target price of $169 gives AAPL stock implied upside of about 10% over the next 12 months or so. During this period, the stock only suffered one major downside correction which extended from late 2012 through mid-2013 when stock price retraced from $100.01 on Sept. 17, 2012, down to $56.65 a share on June 24, 2013. Dorado, PR 00646, Metro Office Park The firm competes in more slow-moving markets rather than fighting to be the supplier for iPhones, for example. Comparative advantage is an economy's ability to produce a particular good or service at a lower opportunity cost than its trading partners. With all of Apple's success, it's easy to forget what a terrible stock it was in the decade following Steve Jobs' demotion and subsequent resignation from the company in the mid 1980s. In the process, Apple's market capitalization has dropped to $2.45 trillion from $2.97 trillion a loss of more than a half-trillion dollars in shareholder value. Wenn Sie Ihre Auswahl anpassen mchten, klicken Sie auf Datenschutzeinstellungen verwalten. The closing share price quoted for Apple for Jan. 2, 2002, the first trading day of the year, was $23.30. $10,000 Invested In 1991 Is Now Worth: $13,660,000. What sorts of superstocks are capable of becoming 100-baggers? Then a series of reforms and modernizations occurred and rail regained the cost advantage against trucking. Moreover, the company remains highly profitable, thanks to its scale, with GAAP net income of $11.6 billion last year. The S&P 500 rose 221.54% and the price of gold Invest better with The Motley Fool.

Under the visionary leadership of the late Steve Jobs, Apple essentially reinvented itself for the mobile age, launching revolutionary gadgets such as the iPod, MacBook and iPad. By comparison, rival Microsoft saw its shares soar 3,500% during this same 10-year stretch. In fact, he's admitted to making a mistake by not buying Google and Amazon.com shares in the past. Cost basis and return based on previous market day close. Meanwhile, the Street's average target price of $169 gives AAPL stock implied upside of about 10% over the next 12 months or so. During this period, the stock only suffered one major downside correction which extended from late 2012 through mid-2013 when stock price retraced from $100.01 on Sept. 17, 2012, down to $56.65 a share on June 24, 2013. Dorado, PR 00646, Metro Office Park The firm competes in more slow-moving markets rather than fighting to be the supplier for iPhones, for example. Comparative advantage is an economy's ability to produce a particular good or service at a lower opportunity cost than its trading partners. With all of Apple's success, it's easy to forget what a terrible stock it was in the decade following Steve Jobs' demotion and subsequent resignation from the company in the mid 1980s. In the process, Apple's market capitalization has dropped to $2.45 trillion from $2.97 trillion a loss of more than a half-trillion dollars in shareholder value. Wenn Sie Ihre Auswahl anpassen mchten, klicken Sie auf Datenschutzeinstellungen verwalten. The closing share price quoted for Apple for Jan. 2, 2002, the first trading day of the year, was $23.30. $10,000 Invested In 1991 Is Now Worth: $13,660,000. What sorts of superstocks are capable of becoming 100-baggers? Then a series of reforms and modernizations occurred and rail regained the cost advantage against trucking. Moreover, the company remains highly profitable, thanks to its scale, with GAAP net income of $11.6 billion last year. The S&P 500 rose 221.54% and the price of gold Invest better with The Motley Fool. The stock briefly hit the $207.05 per share price that was needed to bring Apple to the $1 trillion mark before retreating, CNBC reports . Copyright 2023 InvestorPlace Media, LLC. Following their impressive growth over the last few decades, these three tech stocksgenerate huge profits that should still climb, since they have transformed their businesses to address secular growth opportunities, such as cloud computing and 5G. Apple's all-time stock growth, as of August 2, 2018 at 12:36 p.m. (Click to enlarge.). Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. Apple stock has lost more than $500 billion in value since its peak, but its long-term performance tells another story. Over the past few years, the idea of 100-baggers has gotten popular. But what's really eye-popping is how much its original investors have made, or would have made if they held onto their shares. APE stock popped 13.5% to 1.68. The companys flagship device iPhone accounted for 50.2% of total revenues. Although Apple has been nothing short of spectacular for long-term investors, its performance in 2022 leaves a lot to be desired.

Youre reading a free article with opinions that may differ from The Motley Fools Premium Investing Services. Guaynabo, PR 00968, By clicking "Continue" I agree to receive newsletters and promotions from Money and its partners. For one, it started off the 1990s with a microscopic market cap. Indian man pleads not guilty to human smuggling across Canadian border, UPDATE 1-UK to offer COVID-19 vaccines for young children with medical conditions, Stock futures muted ahead of key jobs report: Stock market news today, UPDATE 1-Match, Indian startups call for antitrust probe of Google in-app billing fee, UPDATE 1-India and China spar over visas for their journalists. One other important thing about superstocks: Theyre not just tech companies either. Source: Domagoj Kovacic / Shutterstock.com, Source: Paul Brady Photography / Shutterstock.com, Source: Katherine Welles / Shutterstock.com, 5 Hypergrowth Stocks With 10X Potential in 2023. Another factor that can influence investors is FOMO, or the fear of missing out, especially with tech giants and popular consumer-facing stocks. As a result of this impressive growth since 1971, $10,000 invested at Intel's IPO would have grown to $29.5 million by now,and that excludes any dividends you would have collected since 1992. To make the world smarter, happier, and richer. The investors that had the foresight to own MNST stock the whole way up have now earned returns beyond anyones wildest dreams. If you're interested in investing in the stock market, try an index fund that follows the S&P 500, which tracks the stock performance of the top 500 American companies.

Have a look at the above chart and you'll see that if you invested $1,000 in Apple stock 20 years ago, it would be worth more than $695,000 today. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. It wasnt until 2004 that the firms market cap topped $100 million. That's one of the largest nominal-dollar dividend payouts in the world. The magnitude of Tesla's boom is almost difficult to fathom. If you invested $10,000 in 3M (NYSE: MMM) a decade ago, it would be worth roughly $9,900 today. This book will teach According to our calculations, a $1000 investment From September 1987 to September 1997, Apple stock lost more than 60% of its value. Microsoft has been a standout performer through multiple tech booms now. Apple has aprice/earnings ratio(P/E) of 19.31. On the date of publication, Ian Bezek held a long position in ROP, GBCI and TXN stock. The past year was tough for NextEra Energy shareholders. Of the 45 analysts covering Apple stock tracked by S&P Global Market Intelligence, 25 rate it at Strong Buy, nine say Buy and nine call it a Hold. In 2007, it followed up with the launch of the now-famous iPhone, which revolutionized the cell phone industry. Unlike many of today's hottest tech names, like Netflix or Pandora Media, Apple has been around for decades. Type a symbol or company name. Therefore, investors may do well to consider buying Apple for future returns on investment. Rounding to the nearest whole share, a $100 investment would have secured four shares of Apple stock. The Motley Fool has a disclosure policy.

Have a look at the above chart and you'll see that if you invested $1,000 in Apple stock 20 years ago, it would be worth more than $695,000 today. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. It wasnt until 2004 that the firms market cap topped $100 million. That's one of the largest nominal-dollar dividend payouts in the world. The magnitude of Tesla's boom is almost difficult to fathom. If you invested $10,000 in 3M (NYSE: MMM) a decade ago, it would be worth roughly $9,900 today. This book will teach According to our calculations, a $1000 investment From September 1987 to September 1997, Apple stock lost more than 60% of its value. Microsoft has been a standout performer through multiple tech booms now. Apple has aprice/earnings ratio(P/E) of 19.31. On the date of publication, Ian Bezek held a long position in ROP, GBCI and TXN stock. The past year was tough for NextEra Energy shareholders. Of the 45 analysts covering Apple stock tracked by S&P Global Market Intelligence, 25 rate it at Strong Buy, nine say Buy and nine call it a Hold. In 2007, it followed up with the launch of the now-famous iPhone, which revolutionized the cell phone industry. Unlike many of today's hottest tech names, like Netflix or Pandora Media, Apple has been around for decades. Type a symbol or company name. Therefore, investors may do well to consider buying Apple for future returns on investment. Rounding to the nearest whole share, a $100 investment would have secured four shares of Apple stock. The Motley Fool has a disclosure policy. The boxy Mac made computing more accessible to the general public, and gave rise to the computer mouse and a more graphical interface.

These seven superstocks made investors at least 100 times their original investment. To begin with, Apple is the most valuable brand in the world, according to a report by Kantar BrandZ. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities. The worlds most famous investor isnt a big buyer of technology stocks. From January 1990 through December 2020, AAPL stock created $2.67 trillion in shareholder wealth, or an annualized dollar weighted return of 23.5%, according to an analysis by Hendrik Bessembinder, a finance professor at the W.P. Buffett's investment company, Berkshire Hathaway publicly shared that it had taken its first bite of Apple on May 16, 2016 when the stock stood at about $92.

These seven superstocks made investors at least 100 times their original investment. To begin with, Apple is the most valuable brand in the world, according to a report by Kantar BrandZ. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities. The worlds most famous investor isnt a big buyer of technology stocks. From January 1990 through December 2020, AAPL stock created $2.67 trillion in shareholder wealth, or an annualized dollar weighted return of 23.5%, according to an analysis by Hendrik Bessembinder, a finance professor at the W.P. Buffett's investment company, Berkshire Hathaway publicly shared that it had taken its first bite of Apple on May 16, 2016 when the stock stood at about $92.  In 2012, Apple began paying a regular quarterly dividend.

In 2012, Apple began paying a regular quarterly dividend.